Posted by

David Templeton, CFA

at

12:20 PM

2

comments

![]()

![]()

Labels: Dividend Analysis

"...Thanks to the proliferation of mutual funds and exchange-traded funds tied to commodities indexes, speculative buying has gone way beyond anything the domestic commodities markets have ever seen. By one estimate, index funds right now account for 40% of all bullish bets on commodities. The speculative juices are even more plentiful -- nearly 60% of bullish positions -- if you count the bets placed by traditional commodity "pools."

Here's the problem: The speculators' bullishness may be way overdone, in the process lifting prices far above fair value. If the speculators were to follow the commercial players -- the farmers, the food processors, the energy producers and others who trade daily in the physical commodities -- they'd be heading for the exits. For right now, the commercial players are betting on price declines more heavily than ever before, says independent analyst Steve Briese.

For example, in the 17 commodities that make up the Continuous Commodity Index, net short positions by the commercials have been running more than 30% higher than their previous net-short record, in March 2004.

Posted by

David Templeton, CFA

at

10:49 AM

0

comments

![]()

![]()

Labels: Commodities

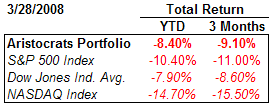

In a recent article by Liz Ann Sonders of Charles Schwab (SCHW) titled Election Economics, she notes interesting stock market patterns over the course of an election cycle. She provides the following caution though:

"Is the election becoming a bigger factor for the stock market? From the perspective of investors and Wall Street, does it matter who wins in November? I strongly believe that the economic atmosphere is more the context in which the president maneuvers and less the outcome of the president’s actions. As such, I feel there is some risk in overstating the impact of the election on stock market returns. And making investment decisions based on anticipated election results is a dicey strategy—one which we wouldn’t recommend."

Posted by

David Templeton, CFA

at

8:06 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

7:21 AM

0

comments

![]()

![]()

Labels: Technicals

Unless a broker has run off with your assets, the securities you own will be available, even if the firm files for bankruptcy. Your biggest worry becomes how long it will take to get your money, but that's only a cause for concern if the back-office operations of the firm are in disarray. In the event of a financial crisis, an organization known as the Securities Investor Protection Corp. (SIPC) will step in to make sure that customer accounts are transferred to a financially sound institution. That's what happened when Cincinnati-based Donahue Securities collapsed in 2001.

SIPC steps in to cover losses only when assets disappear due to wrongful conduct, such as misappropriation, by the broker. In that case, SIPC covers losses up to $500,000 per account. (Only $100,000 may be in cash.) Most brokerage firms carry excess coverage for losses above this amount. You won't be covered for losses due to a drop in security prices.

Since deposit accounts become liabilities of the bank, it follows that the depositor would become a creditor in the event a bank failed. However, the FDIC insures depositors for up to $100,000 per individual per bank.

Since assets held in trust, fiduciary and custodial accounts do not become liabilities of the bank (title is held by the account's owner(s)), it follows that none of this property is subject to the claims of the bank's creditors. As a result, a failure of a bank will have no adverse effect on trust, fiduciary or custodial accounts: they remain the property of the account's owner(s).

Posted by

David Templeton, CFA

at

6:51 PM

1

comments

![]()

![]()

Labels: Investments

Over the past four months, Standard and Poor's upgraded five stocks to A+. The stocks affected are:

S&P notes:

S&P notes:"In the eight years since the bursting of the technology bubble in March 2000, high-quality stocks (as measured by a proprietary Standard & Poor’s system) have outperformed lower-quality issues. In the last 96 months, high-quality stocks have put up an average monthly gain of 0.4%, while lower-quality issues have gained only 0.3%.Source:

Standard & Poor’s has provided Quality Rankings for stocks since 1956. For performance measurements, S&P considers any stock with a Quality Ranking of A- or above to be high quality."

Posted by

David Templeton, CFA

at

6:22 PM

0

comments

![]()

![]()

Labels: Investments

"...The index now trades at about 1.3-times its reported book value, down from more than 2-times just last year and more than 3-times when the tech bubble burst several years ago. Granted, this credit cycle is different, and book value is difficult to measure because banks are still holding enormous amounts of difficult-to-value securities on their books. Financial stock bears note that once goodwill and other intangibles are removed from banks’ reported equity, their so-called “tangible” book values are much lower. As a result, these banks are still somewhat pricey on the basis of price to tangible book value. We remain cautious about major banks that still face losses on actual mortgage assets, not just on securities. But we think that the stocks of the major securities firms are looking attractive for those with a tolerance for risk. We believe that the Fed’s move to open the discount window to these companies, along with its decision to accept nonagency mortgage-backed securities as collateral in exchange for Treasuries, should calm the trading markets with time."

Posted by

David Templeton, CFA

at

5:01 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

10:58 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

3:15 PM

0

comments

![]()

![]()

Labels: Investments

The Chart of the Day notes:

"Gold has been in a strong bull market since 2001 and picked up the pace in mid-2005 and then again in mid-2007. In fact, gold has gone parabolic and today briefly crossed the $1000 per ounce level for the first time. Today's chart illustrates how the price of gold has nearly quadrupled during its seven year bull market."

Source: Chart of the Day

Source: Chart of the Day

Posted by

David Templeton, CFA

at

9:04 PM

0

comments

![]()

![]()

Labels: Commodities , Investments

Posted by

David Templeton, CFA

at

10:31 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

2:15 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

7:13 PM

0

comments

![]()

![]()

Labels: Dividend Return