In a recent article by Liz Ann Sonders of Charles Schwab (SCHW) titled Election Economics, she notes interesting stock market patterns over the course of an election cycle. She provides the following caution though:

"Is the election becoming a bigger factor for the stock market? From the perspective of investors and Wall Street, does it matter who wins in November? I strongly believe that the economic atmosphere is more the context in which the president maneuvers and less the outcome of the president’s actions. As such, I feel there is some risk in overstating the impact of the election on stock market returns. And making investment decisions based on anticipated election results is a dicey strategy—one which we wouldn’t recommend."

- It’s rare when a sitting president is not eligible for re-election. During the past 60 years, that’s occurred only three times—after the two-term presidencies of Dwight D. Eisenhower in 1960, Ronald Reagan in 1988 and Bill Clinton in 2000. Interestingly, stock market returns were subpar during those three years, averaging a slight loss, while bonds fared much better (sound familiar?).

- This is also the first time in over 50 years that neither a sitting president nor vice president is in the race for the nomination.

(click on chart for larger image)

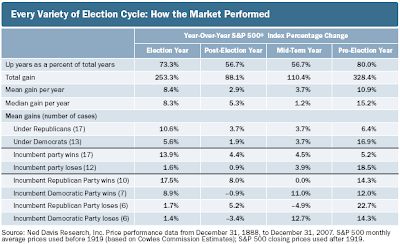

A more detailed look at market performance is contained in the below table.

(click on table for larger image)

Source:

Election Economics

Investing Insights

Charles Schwab & Co., Inc.

By: Liz Ann Sonders

March 20, 2008

http://www.schwab.com/public/schwab/research_strategies/market_insight/todays_market/recent_commentary/

election_economics.html?cmsid=P-2491582&lvl1=research_strategies&lvl2=market_insight&refid=P-2187533&refpid=P-994220

No comments :

Post a Comment