On January 4th Standard & Poor's increased its recession risk forecast to 50% from 40%. S&P believes a recession may not occur from a definitional standpoint (at least 2 consecutive quarters of negative GDP growth), but will feel like one (?). I suppose perception is reality. In any event, S&P believes consumers' spending is tapped out due to higher oil prices and the difficult state of the housing market.

While foreign economies have picked up the slack coming from the U.S., they note:

While foreign economies have picked up the slack coming from the U.S., they note:

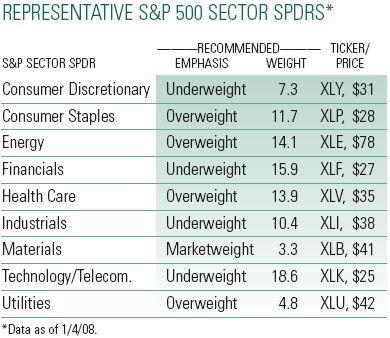

The danger is that the foreign economies may weaken more than expected. Europe and Japan have both relied on trade surpluses to offset soft domestic demand. Can these regions improve their domestic demand enough to offset the weaker exports to the U.S.?S&P's recommended sector weightings are noted below.

Source:

Recession Risk Rises

The Outlook Online

Standard & Poor's

January 16, 2008

http://www.outlook.standardandpoors.com/NASApp/NetAdvantage/mkt/OutlookMarketInsight.do?subtype=

OWMO&pc=NET&tracking=NET&context=Company&docId=12613253

1 comment :

It's hard not to feel the squeeze these days.

Post a Comment