Posted by

David Templeton, CFA

at

7:36 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

9:26 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

10:54 PM

2

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

11:43 AM

0

comments

![]()

![]()

Labels: Investments

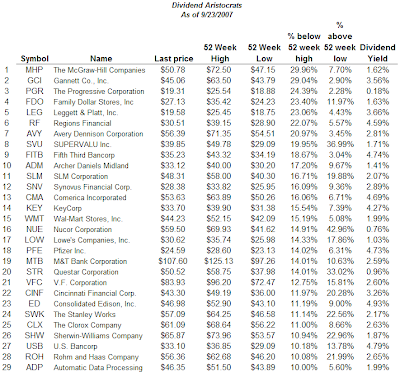

Certainly an interesting week with the Fed lowering both the Fed Funds Rate and the Discount Rate by 50 basis points on Tuesday. The Fed's action added fuel to the fire and propelled the market higher on the week. Standard & Poor's Dividend Aristocrats generally kept pace with the market on the week.

Posted by

David Templeton, CFA

at

11:51 PM

0

comments

![]()

![]()

Labels: Dividend Return

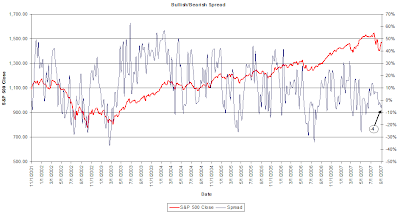

In yesterday's investor sentiment release by the American Association of Individual Investors, the level of bullishness ticked fractionally lower to 39.24% versus last week's 40.00%. The level of bearishness, however, declined to 31.65% versus last week's 35.29%. The prior week's bears moved more towards a neutral stance. The net result is the bull minus bear spread moved higher to +8 versus last week's +5.

In yesterday's investor sentiment release by the American Association of Individual Investors, the level of bullishness ticked fractionally lower to 39.24% versus last week's 40.00%. The level of bearishness, however, declined to 31.65% versus last week's 35.29%. The prior week's bears moved more towards a neutral stance. The net result is the bull minus bear spread moved higher to +8 versus last week's +5.

Posted by

David Templeton, CFA

at

8:18 AM

0

comments

![]()

![]()

Labels: Technicals

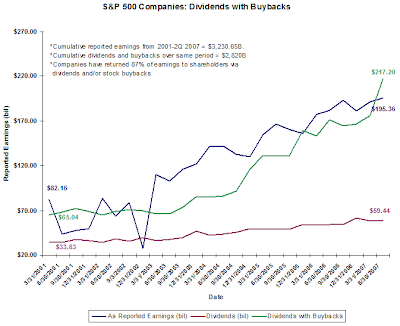

- The record buyback activity was fueled by IBM’s landmark $15.7 billion stock buyback during the second quarter.

- Large quarterly buybacks were also reported by Exxon Mobil at $7.6 billion and Microsoft at $7.2 billion.

- Over the past eleven quarters, when the buyback bonanza started, S&P 500 issues have spent approximately $1.12 trillion on stock buybacks compared to (a similar) $1.24 trillion on Capital Expenditures and $594 billion on dividends.

- Standard & Poor’s also notes that the top-ten buyback issues accounted for 35% of all stock buybacks during the quarter with an aggregate amount of over $54 billion.

Posted by

David Templeton, CFA

at

10:44 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

6:27 PM

0

comments

![]()

![]()

Labels: Technicals

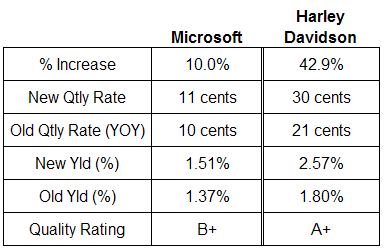

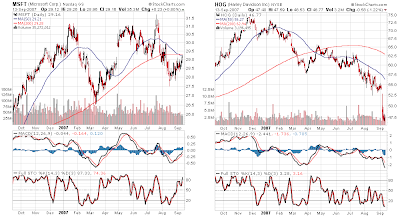

Microsoft announced a 10% increase in their quarterly dividend. The quarterly dividend increases to 11 cents per share versus 10 cents per share in the same quarter last year. The estimated payout ratio will equal 25% based on June 2008 estimated earnings of $1.73. The 5-year average payout ratio is approximately 23% excluding the $3.00 special dividend in 2005.

Harley Davidson announced a 42.9% year over year dividend increase. The new quarterly dividend increases to 30 cents per share versus 21 cents per share in the same quarter last year. The company did increases its quarterly dividend in the 2nd quarter this year to 25 cents per share. The estimated payout ratio will equal 31% based on estimated 2008 earnings of $3.88. The 5-year average payout ratio is approximately 13%. The payout ratio in 2002 equaled 7%.

Posted by

David Templeton, CFA

at

10:34 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

7:53 PM

1

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:00 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

5:18 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

8:44 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

8:24 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

11:29 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

10:17 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

10:59 AM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

9:53 AM

0

comments

![]()

![]()

Labels: General Market