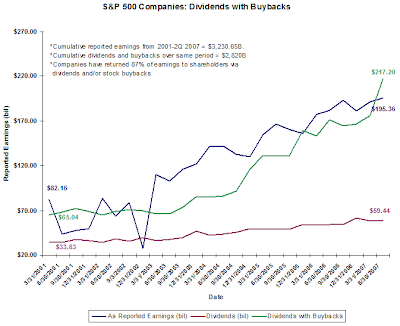

In the 2nd quarter of 2007 Standard & Poor's reports stock buyback activity continues at a record pace. As noted in the chart below, the combined amount of buybacks plus dividends exceeded reported earnings in the quarter. Howard Silverblatt, Senior Index Analyst at Standard & Poor's notes:

- The record buyback activity was fueled by IBM’s landmark $15.7 billion stock buyback during the second quarter.

- Large quarterly buybacks were also reported by Exxon Mobil at $7.6 billion and Microsoft at $7.2 billion.

- Over the past eleven quarters, when the buyback bonanza started, S&P 500 issues have spent approximately $1.12 trillion on stock buybacks compared to (a similar) $1.24 trillion on Capital Expenditures and $594 billion on dividends.

- Standard & Poor’s also notes that the top-ten buyback issues accounted for 35% of all stock buybacks during the quarter with an aggregate amount of over $54 billion.

(click on chart for larger image)

Source:

S&P 500 2nd Quarter Buyback Activity Sets Record at $158 Billion

Standard & Poor's

By: David R. Guarino & Howard Silverblatt

September 6, 2007

http://www2.standardandpoors.com/portal/site/sp/en/us/page.article/2,3,2,2,1148434843833.html

No comments :

Post a Comment