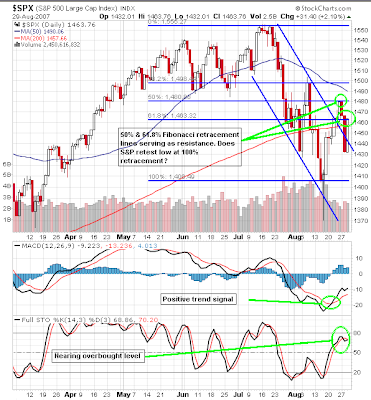

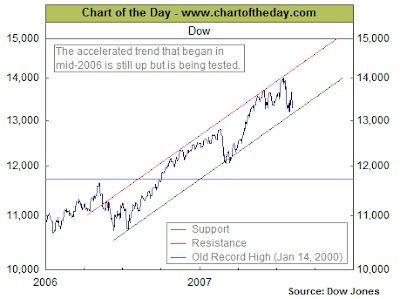

The S&P 500 Index was able to hold together a bit of a rally today; however, the rally occurred on lower volume.

- The close today remains below the 50-day moving average.

- The stochastic indicator is in short term over bought territory.

- The market advance since August 16th has occurred on declining volume.

(click on chart for larger image)

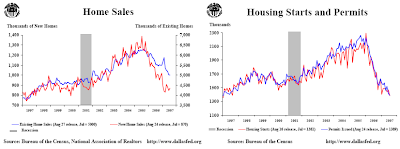

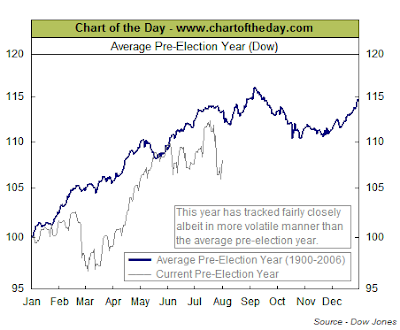

Ten years from now it is likely this part of the market cycle will be barely visible on a long term market chart. On the other hand, many times the amount of money one makes is not based on the price at which an investment is sold, rather the price paid for the investment. Investors that purchased real estate last year are finding this out today.

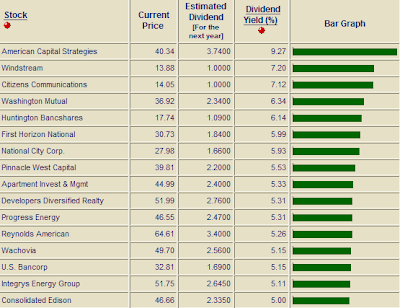

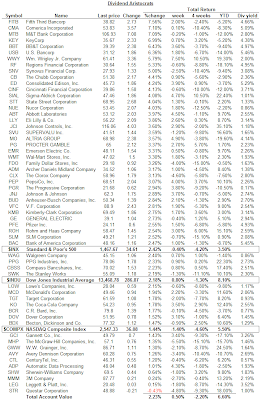

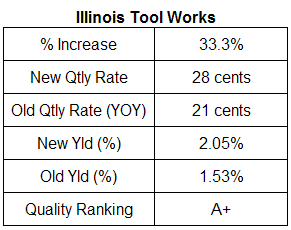

Given the somewhat poor technical picture of the market, this doesn't mean there aren't some attractively valued stocks in the market right now. The point is one should be selective when making their investment decisions and only committing dollars that can remain in the market for the long term.

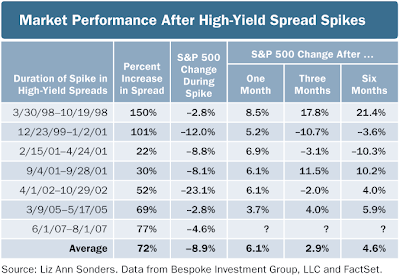

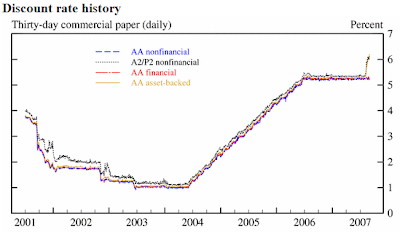

One issue that could negatively impact market sentiment is the liquidity events occurring in the asset backed commercial paper market. Asset backed commercial paper rates have spiked to levels over 6%. The liquidity concerns could cause the equity market to retest its recent low just above 1,400. This could be the event that causes the Fed to lower the Fed Funds rate and set off an equity market rally.

(click on chart for larger image)

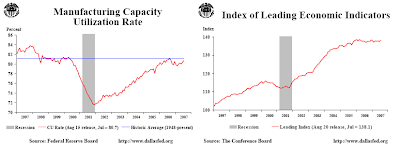

Source: Federal Reserve

Source: Federal Reserve