Historically, in a given year, the equity market incurs its weakest performance in the month of September. Many factors seem to be converging this September that may result in history repeating itself.

(click on charts for larger image)

Source: Chart of the Day

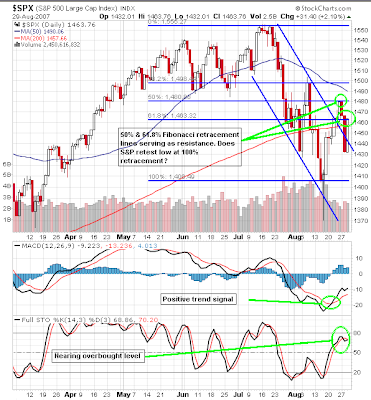

Source: Chart of the DayAs detailed in the S&P 500 chart below, the index is not on the firmest technical footing.

Over the next 90 days more than half of the $1.1 trillion market value of commercial paper comes due. In a minority of cases, some company's that invested excess cash in commercial paper vehicles are having difficulty redeeming their investments.

In the Canadian market, the uranium company Cameco (NYSE ticker: CCJ) has C$13 million invested in asset-backed commercial paper held in two trusts: C$7.5 million in Apsley Trust, managed by Metcalf & Mansfield and C$5.5 million in Planet Trust, managed by Coventree Capital. Both matured on August 17, 2007, but neither counterparty has paid Cameco...The company has more than 20% of its 'portfolio' invested in these short term notes.

The other cloud forming over the market is the repricing of subprime mortgage debt.

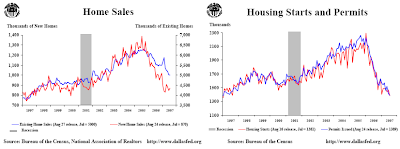

Today, the 1-year ARM rates inexplicably gapped higher. The rate jumped to 6.51% versus the prior week's 5.84%. If these shorter term mortgage rates remain elevated, it will likely place additional stress on subprime borrowers when their loan rate resets. All of this is having an impact on home sale/home construction market:

All the news is not bad though. Economically, the U.S. economy continues to grow at a non inflationary rate.

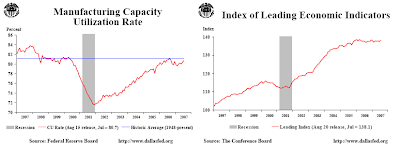

All the news is not bad though. Economically, the U.S. economy continues to grow at a non inflationary rate.- The factory utilization rate is at a high level, but not at a level that would concern the Fed from an inflation perspective as noted in the charts below.

- GDP came in at 3.4% in the second quarter and the unemployment rate remains below 4%.

In a market environment such as this, higher quality 'dividend growth' equities can serves as a port in the potential storm.

In a market environment such as this, higher quality 'dividend growth' equities can serves as a port in the potential storm.Source:

Someone Else's Liability: Miners Caught Short In Treasury Game

CommodityOnline

August 23, 2007

http://www.commodityonline.com/newnews.php?id=2415

U.S.Economic Data: Weekly Chart Presentation

Federal Reserve Bank of Dallas

http://www.dallasfed.org/data/usdata.html#usshow

No comments :

Post a Comment