Niels Jensen's, of Absolute Return Partners, market letter to investors notes how Modern Portfolio Theory (MPT) has become less effective over time. Over the past few years we have written several posts (here and here) on the problems with MPT. One chart in the Jensen's market letter displays the increasing correlation between asset classes that has developed since 2000 thus limiting the effectiveness of diversification as outlined in Modern Portfolio Theory.

|

| From The Blog of HORAN Capital Advisors |

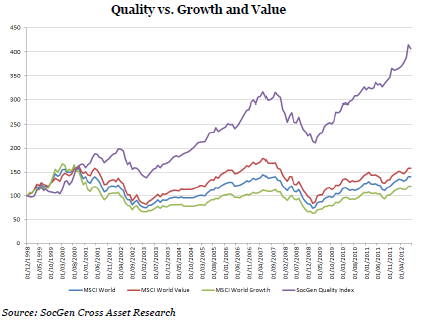

Additionally, the market letter notes the outperformance of "quality" stocks versus say growth or value. As the letter states, quality refers to the strength of a company's balance sheet as well as the sustainability of its dividend policy.

|

| From The Blog of HORAN Capital Advisors |

A key for investors is to understand the approach taken by their investment manager in constructing their investment portfolio.

Source:

When Career Risk Reigns (PDF)

Absolute Return Partners LLP

By: Niels J. Jensen

October 2012

http://www.arpllp.com/core_files/The_Absolute_Return_Letter_1012.pdf

No comments :

Post a Comment