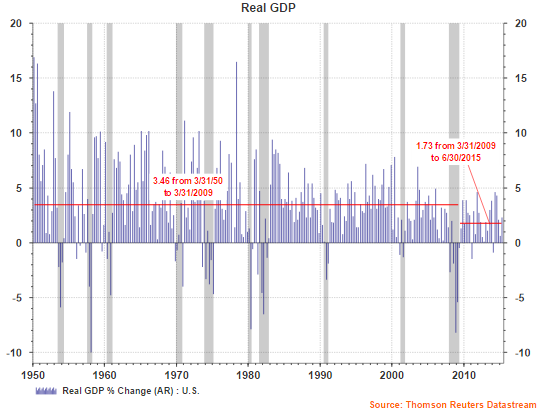

For historically good reasons investors get fixated around Federal Reserve policy changes that lead to changes in the direction of interest rates. These interest movements provide investors with insight into the Fed's perspective on the economy. In short, in an overheating economy, the Fed will push rates higher in an effort to contain potential inflationary pressures. In an economy that is weakening, the Fed lowers rates in order to establish an environment that will stimulate economic growth.

In the past we have written that an increase in interest rates is not necessarily a negative for stock returns. This has especially been the case when rates are increased at levels below 4%. The thinking is a rate increase at this time is the Fed's desire to get rates back to a more normal level to have a tool at their disposal in the event there is some type of economic shock to the system. When rates are increased beyond 4%, this generally is a signal by the Fed it desires to slow economic growth to contain inflationary pressures and this is the point in time that rate increases can be a negative for stock price returns.

So we sit here today and investors/strategists seem to have heartburn around an impending rate increase. However, as the two charts below show, stocks actually move higher in tandem with a rising Fed Funds Rate (yellow line).

As the above chart does show, at the initial onset of a rate hike, the market does tend to be more volatile and trend lower for a brief period of time. Over the course of the cycle, however, the equity market is positively correlated to the higher rate moves.

I do understand the concern about a rate hike at this point in time: emerging market slowdown, stronger dollar and its short term negative impact on exports, but, a rate hike of 25 basis points from this starting point should not have a huge negative impact to the market and the economy. The Fed should probably initiate the initial increase to remove investor fixation on this issue.