Friday afternoon one technical indicator, the Hindenburg Omen, seemed to dominate the discussion of a number of market pundits.

The blog at stockcharts.com provides the following criteria in order for the indicator to be triggered,

"Hindenburg Omen: Created by James Miekka, the Hindenburg Omen warns of potential weakness in the stock market. There are three criteria to activate the omen. First, NYSE new highs and new lows must both be more than 2.8% of advances plus declines. Second, the NY Composite is above the level it was 50 days ago. Third, the number of new highs cannot be more than double the number of new lows. The activation period is good for 30 days. Once active, a sell signal is triggered when the McClellan Oscillator moves below zero and negated when the McClellan Oscillator moves back above zero."

|

| From The Blog of HORAN Capital Advisors |

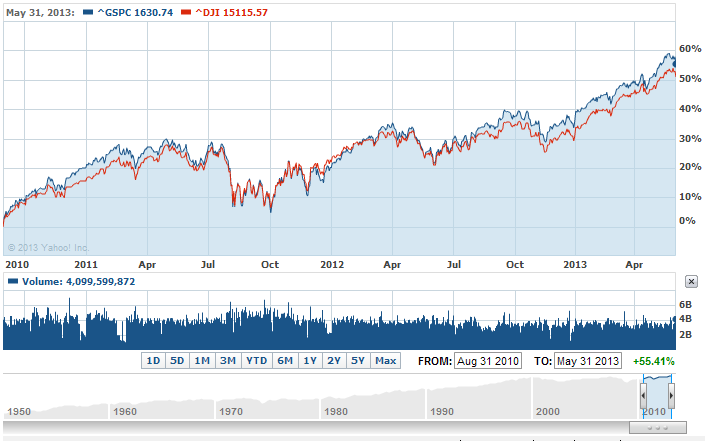

Although the analyst in the CNBC video implies the Hindenburg Omen hasn't been triggered in a few years, it was last triggered in April. We wrote a post on our blog in August of 2010, The Real Facts About The Recent Hindenburg Omen Trigger, when it was triggered then. Since that August 2010 date, the market has enjoyed one of its better bullish advances.

|

| From The Blog of HORAN Capital Advisors |

I believe Chip Anderson's comment at the conclusion of his chart analysis is appropriate for investors to take to heart.

"Given that this is the second time in two months that this signal has occurred, ChartWatchers would be well advised to look for additional signs of technical weakness in this market."

No comments :

Post a Comment