As interest rates have moved higher, as evidenced by the below chart of the 10-year treasury yield, yield related investments have come under significant downward pressure. The below chart shows the 10-year treasury yield rising from 1.63% in early May to 2.19% at today's close.

|

| From The Blog of HORAN Capital Advisors |

Rising rates have had a negative impact on REITs. Investors that were chasing yield in this low interest rate environment are now experiencing the downside in these investments when market interest rates rise.

|

| From The Blog of HORAN Capital Advisors |

Source: Institutional Imperative

H/T: Abnormal Returns

The above chart was sourced from the website, Institutional Imperative, and the article examines the valuation metrics of REITs. It is a worthwhile read for investors that are searching for yield.

The spike in interest rates has also resulted in investors selling their investments in bond funds. The below chart shows bond funds experienced their first weekly outflow of the year. EPFR and Deutsche Bank report this outflow was the largest outflow ever.

|

| From The Blog of HORAN Capital Advisors |

Source: Quartz

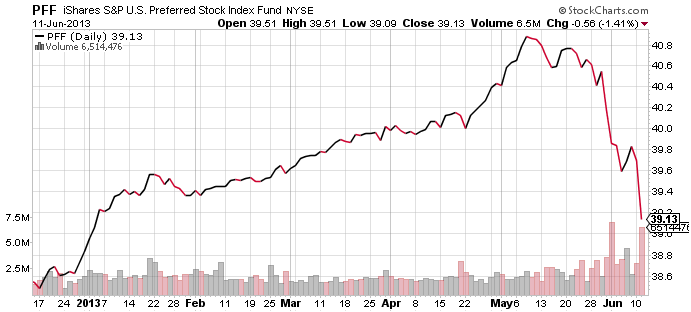

Below is a chart collection of other yield sectors that have been negatively impacted by the recent rise in market interest rates.

|

| From The Blog of HORAN Capital Advisors |

Updated (6/12/2013. 9:03 AM): Including chart of preferreds:

|

| From The Blog of HORAN Capital Advisors |

It would appear the market might be sending the Fed a message that it wants QE to continue unabated. The recent hawkish tone from some Fed members and the comments about "tapering" of the QE programs seems to have certainly spooked the investors.

No comments :

Post a Comment