Approximately two years ago Carmen M. Reinhart and Kenneth S. Rogoff completed a comprehensive study, “

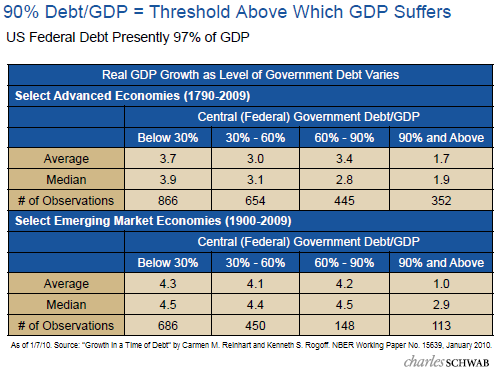

Growth in a Time of Debt”, which looked at public debt levels around the globe and the resultant impact on economic growth for the respective economies. The study noted the historical consequences of various debt levels relative to an economy's GDP growth with the impact of increasing public debt levels on a country's economy being different for emerging and developed economies. The study authors concluded economic growth does tend to suffer significantly when a country's debt to GDP level exceeds 90%. For some emerging economies, debt to GDP levels over 70% begin to constrain growth. In the U.S. public debt to GDP is now over 90%.

Reinhart and Rogoff noted in their study:

"The simplest connection between public debt and growth is suggested by Robert Barro (1979). Assuming taxes ultimately need to be raised to achieve debt sustainability, the distortionary impact imply is likely to lower potential output. Of course, governments can also tighten by reducing spending, which can also be contractionary. As for inflation, an obvious connection stems from the fact that unanticipated high inflation can reduce the real cost of servicing the debt. Of course, the efficacy of the inflation channel is quite sensitive to the maturity structure of the debt. Whereas long-term nominal government debt is extremely vulnerable to inflation, short term debt is far less so. Any government that attempts to inflate away the real value of short term debt will soon find itself paying much higher interest rates...

...In principle, the manner in which debt builds up can be important. For example, war debts are arguably less problematic for future growth and inflation than large debts that are accumulated in peace time. Postwar growth tends to be high as war-time allocation of manpower and resources funnels to the civilian economy. Moreover, high war-time government spending, typically the cause of the debt buildup, comes to a natural close as peace returns. In contrast, a peacetime debt explosion often reflects unstable underlying political economy dynamics that can persist for very long periods."

Finally, as the below chart shows, debt levels in Europe (emerging and developed) and the U.S., have seen significant growth since just 2003.

An important outcome of these higher debt levels will be how each country decides to reduce its dependence on debt (balance governmental budgets), while at the same time not implementing policies that constrain private sector growth.