Posted by

David Templeton, CFA

at

7:38 PM

0

comments

![]()

![]()

Labels: General Market

The percentage of stocks in the S&P 500 Index trading above their 50 day moving average has declined to 34%. This percentage is approaching levels last reached mid year of last year. The percentage of S&P 500 stocks trading above their 150 day moving average remains at a high level of 75%.

|

Posted by

David Templeton, CFA

at

11:09 PM

0

comments

![]()

![]()

Labels: Technicals

"while not as ample [liquidity] as near the lows buying power still remains adequate to power/move stocks higher and keep corrections fairly well contained."

Posted by

David Templeton, CFA

at

10:34 PM

0

comments

![]()

![]()

Labels: Sentiment

|

Posted by

David Templeton, CFA

at

9:36 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Posted by

David Templeton, CFA

at

4:44 PM

0

comments

![]()

![]()

Labels: Sentiment , Technicals

During the depths of the financial crisis last year, high yield spreads widened to near record levels. Spreads in early 2009 approached nearly 2000 basis points. Since that time spreads have narrowed to near their long term average just below 600 basis points.

One question many high yield investors are asking is whether the strong returns in this fixed income segment are behind us. Certainly, the 58% return achieved in the Merrill Lynch High Yield Master II Index in 2009 is not likely to be repeated in 2010. However, as the below chart shows, the spread tends to continue tightening beyond the long term average as the economy improves. Given the low interest rate environment for cash and investment grade debt, investors may continue to chase high yield resulting in further spread tightening.

High Yield Spread 12 2009

Posted by

David Templeton, CFA

at

3:49 PM

0

comments

![]()

![]()

Labels: Bond Market

Posted by

David Templeton, CFA

at

3:23 PM

0

comments

![]()

![]()

Labels: General Market

|

|

|

The ability of management to maintain stable or increasing dividends indicate the quality of the firm’s earnings and its growth prospects. The S&P Common Stock Ranking systems, for over 40 years, ranks stocks in categories based on growth and stability of earnings and dividends. [The below chart shows] ...the distribution of quality ranks of the constituents of the S&P 500 Dividend Aristocrats against those of the S&P 500 Index.

|

|

|

|

Posted by

David Templeton, CFA

at

10:50 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

|

Posted by

David Templeton, CFA

at

10:49 PM

0

comments

![]()

![]()

Labels: General Market

|

|

Posted by

David Templeton, CFA

at

12:59 PM

0

comments

![]()

![]()

Labels: Economy , General Market , Sentiment , Technicals

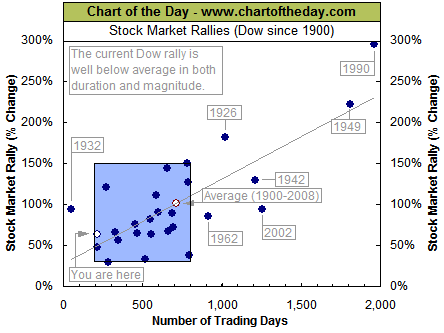

- most major rallies (73%) resulted in a gain of between 30% and 150% and lasted between 200 and 800 trading days.

- the current Dow rally (hollow blue dot labeled you are here) has entered the low range of a "typical" rally and would currently be classified as both short in duration and below average in magnitude.

|

Posted by

David Templeton, CFA

at

5:48 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

|

Posted by

David Templeton, CFA

at

7:50 PM

0

comments

![]()

![]()

Labels: Economy , General Market , Technicals

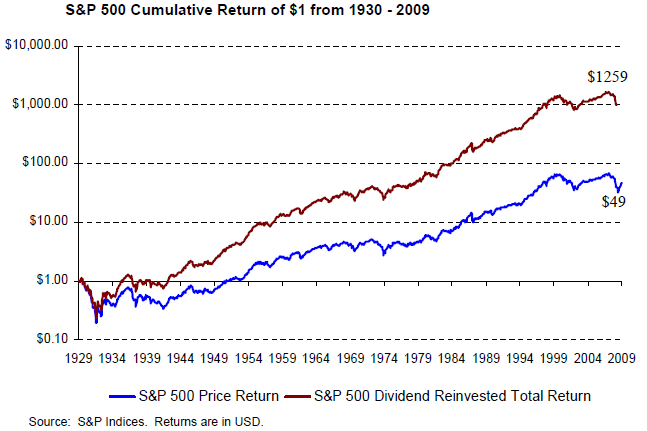

"If an investor had put $1,000 in a portfolio of the 100 highest-yielding stocks on January 1, 1957, by December 1, 2009, he would have accumulated more than $450,000 (assuming all dividends were reinvested). That’s a hefty annualized return of 12.5%, an average of almost 2.5 percentage points per year greater than the return on the S&P index. That same $1,000 invested in the 100 lowest-yielding stocks returned only 8.8% per year."

- for 2007, at the height of the bull market, the dividend stream -- total dividends paid on all U.S. stocks -- was $288 billion.

- for 2009 through November, the dividend stream had dropped to $216 billion -- the greatest decline in that measure since the end of World War II

- the entire decline in dividends can be attributed to the financial sector, which cut its total payouts by $79 billion over the past two years. (Siegel includes General Electric because GE’s dividend reduction was caused solely by the losses at GE Capital.)

- in other sectors of the economy -- energy, health care, technology, consumer discretionary, consumer staples, telecom -- dividends have actually risen over the past two years, even with the recession.

Posted by

David Templeton, CFA

at

11:01 PM

0

comments

![]()

![]()

Labels: Dividend Return

|

|

Posted by

David Templeton, CFA

at

12:09 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:16 PM

0

comments

![]()

![]()

Labels: Sentiment

|

Posted by

David Templeton, CFA

at

11:44 AM

0

comments

![]()

![]()

Labels: Economy

"Obama announced the awarding of $2.3 billion in tax credits to companies that manufacture wind turbines, solar panels, cutting edge batteries and other green technologies. The money will come from last year's $787 billion stimulus program. He also renewed a call by Vice President Al Gore for Congress to approve an additional $5 billion to help create more such jobs."

According to the Cybercast News Service, it is noted,"Spain’s experience (cited by President Obama as a model) reveals with high confidence, by two different methods, that the U.S. should expect a loss of at least 2.2 jobs on average, or about 9 jobs lost for every 4 created, to which we have to add those jobs that non-subsidized investments with the same resources would have created,” wrote Calzada in his report: Study of the Effects on Employment of Public Aid to Renewable Energy Sources"

"in the study’s introduction Calzada argues that the renewable jobs program hindered, rather than helped, Spain’s attempts to emerge from its recession."

“The study’s results show how such 'green jobs' policy clearly hinders Spain’s way out of the current economic crisis, even while U.S. politicians insist that rushing into such a scheme will ease their own emergence from the turmoil,” says Calzada. “This study marks the very first time a critical analysis of the actual performance and impact has been made."

Pat Michaels, professor of environmental sciences at the University of Virginia and senior fellow in environmental studies at the Cato Institute, a free market group, told CNSNews.com that the study’s conclusions do not surprise him. He added that the United States should expect similar results with the stimulus money it spends on green initiatives.

Michaels also said he was not surprised by the study’s finding that only one out of 10 jobs were permanent.

Posted by

David Templeton, CFA

at

5:41 PM

0

comments

![]()

![]()

Labels: Economy

|

|

Posted by

David Templeton, CFA

at

11:24 PM

1

comments

![]()

![]()

Labels: Dividend Return

|

Posted by

David Templeton, CFA

at

7:27 PM

0

comments

![]()

![]()

Labels: General Market

|

Posted by

David Templeton, CFA

at

6:21 AM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

12:14 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Posted by

David Templeton, CFA

at

7:02 PM

0

comments

![]()

![]()

Labels: Investments , Valuation

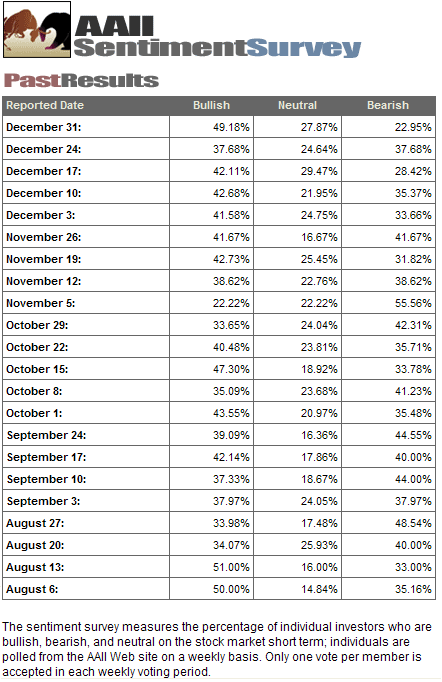

- bullish investor sentiment is reported at 49.18% this week. This is the highest level since 51% was reported on August 13, 2009.

- bearish sentiment is reported at 22.95% and is the lowest bearishness reading since 22.31% on February 27, 2007.

- the bull/bear spread is reported at 26% and is the widest spread since 28% was reported on May 8, 2008.

|

|

|

Posted by

David Templeton, CFA

at

1:16 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment