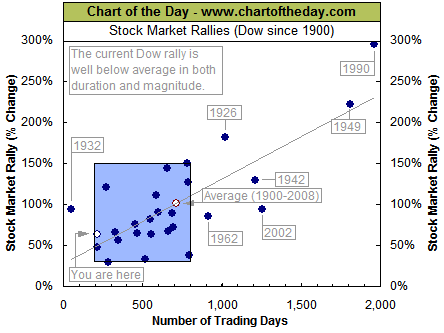

As a follow up to my post yesterday, Positive Equity Market Returns Probable In 2010, the current advance in the Dow Jones Industrial Average (^DJI) is below average in both magnitude and duration as compared to past rallies. The Chart of the Day chart service looked at the prior 27 market rallies since 1900. They note:

- most major rallies (73%) resulted in a gain of between 30% and 150% and lasted between 200 and 800 trading days.

- the current Dow rally (hollow blue dot labeled you are here) has entered the low range of a "typical" rally and would currently be classified as both short in duration and below average in magnitude.

|

Source: Chart of the Day

If company earnings reports meet or exceed expectations on the whole this reporting period, the market could continue to grind higher.

No comments :

Post a Comment