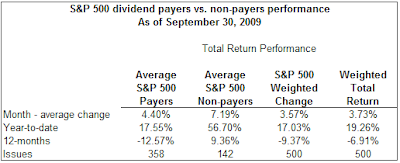

As of the end of September, the return for the dividend payers in the S&P 500 Index continues to badly trail the return of the non payers. On a year to date basis, the payers' return equals 17.55% versus the non payers' return of 56.70%. The strongest performing stocks have been the lower quality ones and these tend to not pay dividends.

(click to enlarge)

Howard Silverblatt noted in a Dow Jones News Wire release:

Howard Silverblatt noted in a Dow Jones News Wire release:In the third quarter, of about 7,000 U.S-traded companies, 191 increased their dividend for the period, down from 346 a year earlier and 439 in 2007. In contrast, 113 companies lowered their dividend payment during the quarter, down from 138 in 2008 but up from just 21 in 2007.

Howard Silverblatt said the third-quarter figures suggested that dividends may have finally hit a bottom. But he warned it may take several quarters of proven results for companies to be comfortable with increasing, or initiating dividends. Even then, Silverblatt said the level will likely be more subdued than what was seen two years ago.

According to Silverblatt, dividend increases have outnumbered cuts every year since 1955, with the average being 15 increases for every decrease. So far this year, the relationship is almost even, with increases at 707 and decreases at 730.

No comments :

Post a Comment