A slew of better economic news continues to be reported. Same of the positive data is detailed below. The question becomes how much of this news is factored into the market at this time.

- Corporate profits are up over 11% in the first two quarters of 2009, .

- Business inventories down significantly on a year over year basis. This decrease in inventory will lead to a need to replenish inventory stock.

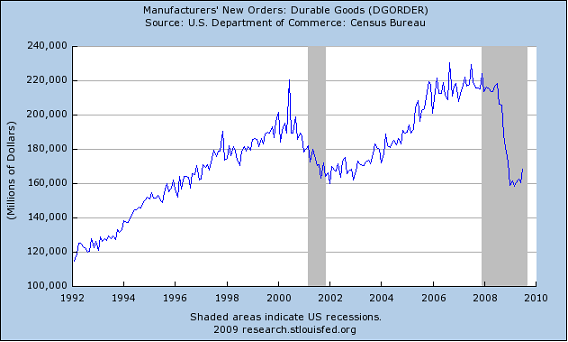

- Durable goods orders were up nearly 5% in July.

- New home sales up nearly 10% on a month over month basis in July.

- Using the Dallas Fed's model, GDP growth in the second half of the year could come in at an annualized rate of 4%.

Undoubtedly, the Armageddon scenario facing investors and the economy in March seems to be off the table. I believe a crucial question at this point in time is how much have the artificial influences skewed the data, i.e., cash for clunkers, one time home buyer credit, stimulus checks, etc. Will these stimulative efforts result in a sustainable economic recovery into 2010?

No comments :

Post a Comment