As important as it may seem to review technical stock market data, an investor should also review technical economic data. The goal is to review the economic data in order to spot potential turning points in the overall economy.

A recent article in Kiplinger's Personal Finance magazine outlined six economic indicators worth reviewing that might help an investor determine the bottom in the economy. When three of the below six indicators turn in a more favorable direction, an economic recovery is likely unfolding.

A recent article in Kiplinger's Personal Finance magazine outlined six economic indicators worth reviewing that might help an investor determine the bottom in the economy. When three of the below six indicators turn in a more favorable direction, an economic recovery is likely unfolding.

Jobless Claims

- Look for a four-week moving average hitting 550,000 and continuing to decline would signal that companies have stopped slashing jobs.

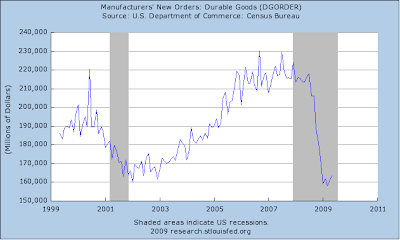

Durable Goods Orders

- A two- or three-month uptrend in orders -- excluding defense, aircraft and other transportation equipment -- would presage an expanding economy.

- Two to three straight months of increasing sales would mean consumers have more money in their pockets and are willing to spend it.

- Two or three consecutive months of growth would be a sign that investors and would-be homeowners are back in the market.

- An index in the 60s would suggest that consumers will be less tightfisted.

- A narrowing of the gap to about one-half of a percentage point would signal improving health in the banking sector.

Source: Bloomberg

Source: BloombergOne last point to keep in mind is the market tends to be leading indicator. As a result, once a number of the data points become more favorable, the market may move higher in advance of the economic data confirming a stronger or improving economy. I wrote a post on March 9th that touched on the lagging nature of the consumer confidence data.

Source:

How To Spot The Bottom

Kiplinger's Personal Finance

July 2009

http://www.kiplinger.com/magazine/archives/2009/07/how-to-spot-the-bottom.html

No comments :

Post a Comment