The President's State of the Union address on Tuesday and his proposed budget on Thursday were game changers for the economy and the market. The budget that is proposed will do little to stimulate economic growth and moves the country rapidly towards a socialistic economy and government. Many have written about the magnitude of this budget:

- Portfolio.com: Obama's total budget is $3.6 trillion, which works out at $34,000 per household; median household income is about $50,000. Which basically means that for every dollar that a US household earns, the US government plans to spend 68 cents next year.

- CNBC: [Obama] is declaring war on investors, entrepreneurs, small businesses, large corporations, and private-equity and venture-capital funds.

That is the meaning of his anti-growth tax-hike proposals, which make absolutely no sense at all — either for this recession or from the standpoint of expanding our economy’s long-run potential to grow.

Raising the marginal tax rate on successful earners, capital, dividends, and all the private funds is a function of Obama’s left-wing social vision, and a repudiation of his economic-recovery statements. Ditto for his sweeping government-planning-and-spending program, which will wind up raising federal outlays as a share of GDP to at least 30 percent, if not more, over the next 10 years.

The question for investors is whether the market has factored in this type of economic structure. I believe the answer is--who knows. As a country we are embarking down an unknown path since these proposed changes have not been tried in this country before. So in what direction does the market move?

The Bespoke Investment Group had a couple of graphics a few days ago detailing today's market action versus the market's correction from 1929 to 1954.

The Bespoke Investment Group had a couple of graphics a few days ago detailing today's market action versus the market's correction from 1929 to 1954.

Source: Bespoke Investment Group

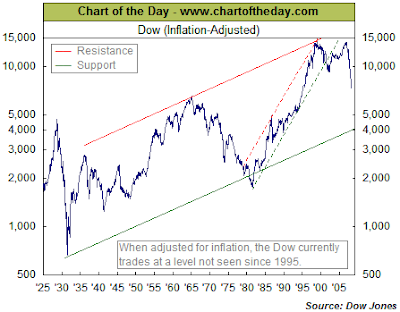

Source: Bespoke Investment GroupThe Chart of the Day provides a chart of the Dow on an inflation adjusted basis. From a technical perspective, will the Dow trade down to test support at the 4,000 level?

Many strategists have lowered earnings estimates for the S&P 500 Index to $45. If one places a 10 P/E on earnings, that would mean the S&P Index could trade down to 450. Today's close on the S&P was 735. The $45 earnings estimate could be trough earnings and the market doesn't necessarily trade on trough earnings, but it is a data point. And, as noted by Smart Money, although GDP was horrible:

The fact that the economy shrank at a rate of 6.2% last quarter -- the worst showing in more than a quarter century -- sounds pretty awful. But here's another way to look at it. The last time GDP dropped so precipitously (back in the first quarter of 1982) the Dow went on to gain 25% in the next 12 months.Let's hope history repeats itself as it applies to GDP centered data.

No comments :

Post a Comment