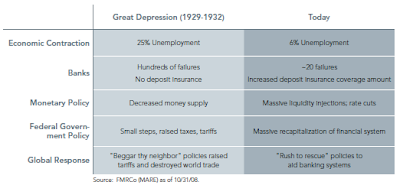

There are major difference between the current economic conditions and the government's response versus those that occurred during the Great Depression in 1929-1932. The below table details some of those differences.

(click to enlarge)

During the early 30's depression, the government responded by decreasing the money supply and raising taxes and tariffs. It would be helpful if the incoming administration strongly stated it would not raise taxes and tariffs as were proposed during the presidential election campaign. The below charts show the government has done everything but reduce the money supply.

During the early 30's depression, the government responded by decreasing the money supply and raising taxes and tariffs. It would be helpful if the incoming administration strongly stated it would not raise taxes and tariffs as were proposed during the presidential election campaign. The below charts show the government has done everything but reduce the money supply.(click to enlarge)

The current bailout pledges now total over $8 trillion which is over 57% of GDP.

So what does all this mean for the future direction of the stock market? Liz Ann Sonders of Charles Schwab & Co noted in a recent report:

So what does all this mean for the future direction of the stock market? Liz Ann Sonders of Charles Schwab & Co noted in a recent report:

"Confidence will also come into play in the stock market—that ultimate mechanism of sentiment. Typically, stock markets bottom about 60% of the way through recessions. We've had 13 recessions since (and including) the Great Depression, 12 of which had accompanying bear markets or major corrections. Only once (2001–2002) did the market continue to sell off after the economy began to recover.

The fourth quarter of this year is likely to post the steepest decline in GDP during this cycle, with a drop of 5% or more in the cards. The worst single quarter ever for GDP was the fourth quarter of 1958, when it declined by a whopping 10.4%. The stock market had been weak heading into that quarter, but 18 months later it was up 52%—and a steady ascent at that. That's by no means a prediction of what we might look forward to, but is a reminder of the market's tendency to price in the worst case scenario before it unfolds, not after.

So, keep an eye on the stock market. Often when it begins to rally on still-bad news, it's a good sign for a pending economic recovery. However, be careful trying to pick a stock market bottom simply based on past recession-related performance."

- Bailout Pledges More Than $8 Trillion (EconomPic Data)

- More Bailout Comparisons (The Big Picture)

- Bailout Pledges Hit $7.7 Trillion (Mish's Global Economic Trend Analysis)

Source:

Five Reasons Why Today Is Different From The Great Depression (PDF)

Market Analysis, Research and Education

By: Dirk Hofschire, CFA

November 25, 2008

http://eresearch.fidelity.com/eresearch/markets_sectors/economic.jhtml#

Recovery Watch 2009

Charles Schwab & Co.

By: Liz Ann Sonders, Chief Investment Strategist

December 2, 2008

http://www.schwab.com/public/schwab/research_strategies/market_insight/todays_market/recent_commentary/recovery_watch_2009.html

2 comments :

Thanks, great article

I wholeheartedly aggree with you regarding the differences between government action in the 30's and now. When you get a chance, take a look at my blog on the same subject and drop me a comment.

Thanks,

John H. Kaighn

Jersey Benefits Advisors

The Kaighn Report

Post a Comment