For the third quarter of 2009, stock buybacks for S&P 500 companies declined to $89.71 billion versus $171.95 billion in the third quarter of 2007. Dividends were actually slightly higher coming in at $61.44 billion versus $61.21 billion in the third quarter of 2007.

(click to enlarge)

Companies appear to be more cautious with their cash as buybacks and dividends decline or remain flat, respectively. In Wal-Mart's (WMT) November conference call (PDF), the company announced they were suspending their buyback program noting:

Companies appear to be more cautious with their cash as buybacks and dividends decline or remain flat, respectively. In Wal-Mart's (WMT) November conference call (PDF), the company announced they were suspending their buyback program noting:During the third quarter, we repurchased approximately $1.3 billion of our stock, which represents approximately 21.4 million shares. As we noted during the analyst meeting, we stepped back on share repurchases in early October. We believe it is more prudent to take a pause while the financial markets settle down (emphasis added). Year to date, we have purchased almost 61.5 million shares. Under our current $15 billion share repurchase authorization, we have spent almost $10 billion to repurchase approximately 203.6 million shares.

Howard Silverblatt, Senior index Analyst at Standard and Poor's noted in the S&P press release:

"Starting in the fourth quarter of last year, companies began to retreat from stock buybacks. Year-to-date, Standard & Poor’s data shows that stock buybacks are coming in at $156 billion less than this time last year."

"Cash levels for the third quarter of 2008 were near an all-time high, so it’s not that companies can’t fulfill buyback programs. They are instead choosing to hold onto the cash, unsure of what the near-term may bring."

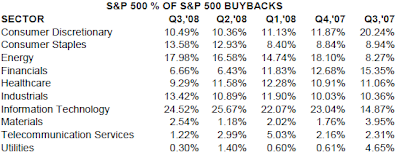

The below table details the buyback trend by S&P 500 sector going back to the third quarter of 2007.

(click to enlarge)

Data Source:

S&P 500 Stock Buybacks Continue At Lower Levels;

Retreat 48% in Third Quarter (PDF)

Standard & Poor's

By: Howard Silverblatt & David R. Guarino

December 10, 2008

http://www2.standardandpoors.com/portal/site/sp/en/us/page.article/2,3,2,2,1204842279743.html

No comments :

Post a Comment