Posted by

David Templeton, CFA

at

11:31 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

9:17 PM

0

comments

![]()

![]()

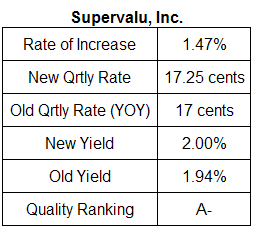

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

10:03 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

3:41 PM

0

comments

![]()

![]()

Labels: Technicals

"the second half of Home Depot's $22.5 billion share-repurchase program remains 'on pause just because of the instability of our business and the instability of the credit markets.'"

Posted by

David Templeton, CFA

at

11:38 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

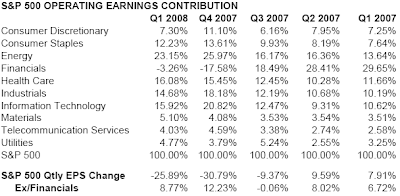

Excluding financials and consumer discretionary stocks, the YOY operating earnings change is fairly respectable.

Excluding financials and consumer discretionary stocks, the YOY operating earnings change is fairly respectable.

Posted by

David Templeton, CFA

at

10:34 AM

0

comments

![]()

![]()

Labels: General Market

Beginning next week and going forward should be interesting for the market. From a short term perspective we could see some sideways market movement as some of the recent gains are digested. Longer term though, the market appears to want to go higher as it climbs the commodity "wall of worry."

Beginning next week and going forward should be interesting for the market. From a short term perspective we could see some sideways market movement as some of the recent gains are digested. Longer term though, the market appears to want to go higher as it climbs the commodity "wall of worry."

Posted by

David Templeton, CFA

at

11:52 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

7:16 PM

0

comments

![]()

![]()

Labels: Technicals

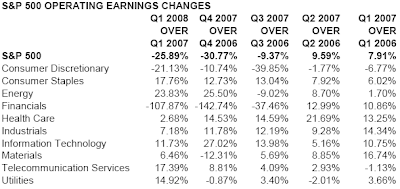

Projecting forward using past values of the spread and GDP growth suggests that real GDP will grow at about a 3.0 percent rate over the next year. This is on the high side of other forecast.

Lastly, as the yield curve steepens (wider yield spread) it does appear future economic activity is stronger one year later. The below chart graphs the yield spread versus GDP lagged by one year.

Lastly, as the yield curve steepens (wider yield spread) it does appear future economic activity is stronger one year later. The below chart graphs the yield spread versus GDP lagged by one year. Two related posts on the yield curve are noted below.

Two related posts on the yield curve are noted below.

Posted by

David Templeton, CFA

at

5:59 PM

0

comments

![]()

![]()

Labels: Economy

Posted by

David Templeton, CFA

at

8:59 PM

0

comments

![]()

![]()

Labels: Investments

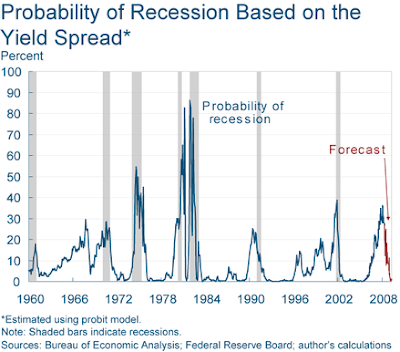

CompanyRate of Increase New Qrtly Rate Old Qrtly Rate (YOY) New Yield Old Yield Quality Ranking Pepsi 13.33% $.425 $.375 2.52% 2.22% A+ Rohm & Haas 10.81% $.41 $.37 3.04% 2.74% A- Granger (W.W.) 14.29% $.4 $.35 1.86% 1.63% A Johnson & Johnson 10.84% $.46 $.415 2.76% 2.49% A+ Procter & Gamble 14.29% $.4 $.35 2.45% 2.15% A+ Exxon Mobil 14.29% $.4 $.35 1.8% 1.58% A+ TJX Companies 22.22% $.11 $.09 1.42% 1.16% A+ Chubb 13.79% $.33 $.29 2.5% 2.2% A- Wal-Mart 7.95% $.2375 $.22 1.66% 1.54% A+ Air Products & Chemical Co. 15.79% $.44 $.38 1.8% 1.55% A

Posted by

David Templeton, CFA

at

3:30 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

9:09 PM

0

comments

![]()

![]()

Labels: Technicals

...on average the stock market peaked about nine months before the onset of recessions, the pattern of each recession is different. In the 1990–91 recession, for example, the market hit its high less than a month before the recession began, while stocks peaked 14.5 months before the most recent recession began in March 2001.

...the market bottomed on average about five months before the end of recessions, this low has ranged from just about two months before the end of the 2001 recession to more than eight months prior to the end of the 1953–54 recession.

Posted by

David Templeton, CFA

at

9:34 PM

0

comments

![]()

![]()

Labels: Economy , General Market

Posted by

David Templeton, CFA

at

9:32 PM

0

comments

![]()

![]()

Labels: Commodities , Economy

The white paper shows:

The white paper shows:Dividends have been a major component of investment return over the long-term. In fact, over the past 45 years, more than 50% of the annualized total return of the S&P 500 Index came from dividends.1 As the chart below shows, $1000 dollars invested in 1960 in the S&P 500 would have grown to over $114,718 today. But if you take away dividends, that same $1,000 dollars would be worth $24,517.21Total return is annual price appreciation, or loss, plus dividends.

2 Source: Lipper Inc. Not meant to represent income from any Eaton Vance fund. S&P 500 Index is an unmanaged index commonly used as a measure of U.S. stock market performance. For illustrative purposes only. Past performance is no guarantee of future results. It is not possible to invest directly in an Index.

Lastly, the white paper details the impact that legislative tax changes have had on the likelihood of companies to pay a dividend. Also, as the baby boomers begin entering retirement, paltry bond yields are enticing the baby boomers to look at dividend paying and dividend growth stocks.

Lastly, the white paper details the impact that legislative tax changes have had on the likelihood of companies to pay a dividend. Also, as the baby boomers begin entering retirement, paltry bond yields are enticing the baby boomers to look at dividend paying and dividend growth stocks.

Posted by

David Templeton, CFA

at

1:09 PM

2

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

9:02 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

8:28 PM

1

comments

![]()

![]()

Labels: Technicals