Posted by

David Templeton, CFA

at

7:48 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

9:54 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

1:32 PM

0

comments

![]()

![]()

Labels: Technicals

The Dow currently trades 13% below its all-time record high. For some further perspective into how the stock market is actually performing, today's chart presents the Dow divided by the price of one ounce of gold. This results in what is referred to as the Dow / gold ratio or the cost of the Dow in ounces of gold. For example, it currently takes 12.9 ounces of gold to “buy the Dow.” This is considerably less than the 44.8 ounces back in the year 1999. When priced in that other world currency (gold), the Dow is in the midst of a massive eight year bear market!

Posted by

David Templeton, CFA

at

12:56 AM

0

comments

![]()

![]()

Labels: Commodities , Investments

Posted by

David Templeton, CFA

at

8:23 PM

0

comments

![]()

![]()

Labels: Technicals

Lesson One: Mixing bonds and stocks moderates portfolio risk.

High-grade bonds and stocks are fundamentally different assets. Bad years for bonds are sometimes good years for stocks and vice versa. During this time period, bonds lost money in three of those years, and in those same years stocks earned money. Conversely, stocks lost money in four of those years, and at the same time, bonds earned money. It is also important to note, though, that 1987 and 1994 were below-average years for both asset classes—that serves as a reminder that both asset classes can have poor years at the same time.

Lesson Two: Portfolio risk rises disproportionately slowly as stocks are added to the portfolio.

Over this time period, the risk (as measured by volatility) of a 25% stock portfolio was essentially the same as the risk of the all-bonds portfolio. The additional risk of a 50% stock portfolio compared to an all-bonds portfolio is one-fourth the additional risk of an all-stocks portfolio.

Lesson Three: An all-bonds portfolio is not the lowest-risk portfolio.

Even risk-averse investors should own some stocks. The maximum annual loss for a 25% stock portfolio was less than the maximum for the all-bonds portfolio. That's because, when interest rates rise, all bond prices move south.

Lesson Four: Portfolio returns rise disproportionately quickly as stocks are added to the portfolio.

Over this time period, the 25% stock portfolio earned about 40% of the additional return on the all-stocks portfolio compared to the all-bonds portfolio. The 50% stock portfolio earned about 75% of the additional return.

Lesson Five: An often-overlooked risk for the long-run investor is the risk of having a too-conservative portfolio.

By focusing too much on volatility of individual assets instead of the volatility of the entire portfolio, many people often maintain a too-small stock exposure for their long-run horizon. Remember that over this time period, the 25% stock portfolio had a volatility similar to the all-bonds portfolio, but its returns were appreciably higher. And for many investors, the risk-return trade-off favors an even higher exposure to stocks.

(click on table for larger image)

Posted by

David Templeton, CFA

at

3:40 PM

0

comments

![]()

![]()

Labels: Asset Allocation

"...for foreign companies within S&P Equity Research’s coverage universe that trade as American Depositary Receipts or Shares on a U.S. exchange, are ranked four or five STARS, and have a dividend yield higher than that of the S&P 500."

Posted by

David Templeton, CFA

at

11:17 AM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

9:44 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

8:54 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

7:30 PM

1

comments

![]()

![]()

Labels: Dividend Analysis

"Cementing many a recession forecast was the most recent jump in the unemployment rate to 5%, bringing the total increase from this cycle's low to 0.6%. That may not sound significant, but an increase of this magnitude has never occurred in a soft landing, only during recessions."

Posted by

David Templeton, CFA

at

11:42 AM

0

comments

![]()

![]()

Labels: Economy , General Market

Posted by

David Templeton, CFA

at

4:10 PM

0

comments

![]()

![]()

Labels: Technicals

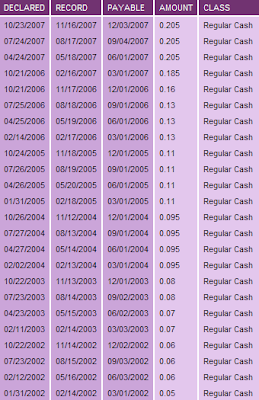

L-3 Communications (LLL), Wm. Wrigley Jr. Co. (WWY) and Cincinnati Financial Corp. (CINF) recently announced increases in their company's cash dividend.

L-3 Communications

Posted by

David Templeton, CFA

at

12:10 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

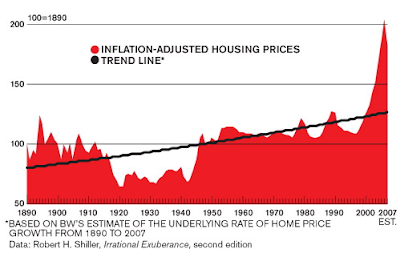

Also, BusinessWeek notes:

Also, BusinessWeek notes:"These regional pie charts show the results of a December survey of 1,509 homeowners asking whether they thought their home's value had risen or fallen over the past year. The survey was conducted by Harris Interactive for Zillow.com. Beneath each pie chart is Zillow.com's estimate of the actual change in house prices for the region over the past year."

As noted in the above chart, a small percentage of homeowners believe the price of their home has declined. This type of thinking is extending the housing slowdown. Once sellers get through the summer and find they still have not sold their home, they will likely become more aggressive in lowering the home sale price. This event could act as a stimulant to reduce housing inventory and finally provide stability in the housing market.

As noted in the above chart, a small percentage of homeowners believe the price of their home has declined. This type of thinking is extending the housing slowdown. Once sellers get through the summer and find they still have not sold their home, they will likely become more aggressive in lowering the home sale price. This event could act as a stimulant to reduce housing inventory and finally provide stability in the housing market."A 20% decline in home prices would wipe out all of the home equity of two-thirds of all people who bought houses in the last year, Zillow.com estimates. The bars show the percentage of recent buyers in each market whose home equity would be wiped out by a further 20% price decline."

Posted by

David Templeton, CFA

at

5:39 PM

1

comments

![]()

![]()

Labels: Economy

Posted by

David Templeton, CFA

at

3:12 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

...Financials (ABK, C, FHN, and MBI) lowered their rate and two (PGR and SOV) suspended it. While there is still concern over the deterioration within the Financials sector, S&P believes the vast majority of S&P 500 companies will continue their long history of dividend payments and increases in 2008.

Posted by

David Templeton, CFA

at

11:38 PM

0

comments

![]()

![]()

Labels: Dividend Return