Source: Chart of the Day

Source: Chart of the Day

Source: Chart of the Day

Source: Chart of the Day

Posted by

David Templeton, CFA

at

8:37 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

9:12 PM

0

comments

![]()

![]()

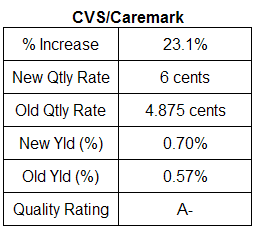

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

6:47 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

6:30 PM

0

comments

![]()

![]()

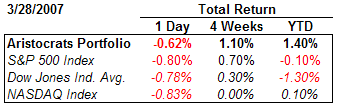

Labels: Dividend Return

Posted by

David Templeton, CFA

at

10:45 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

9:56 PM

0

comments

![]()

![]()

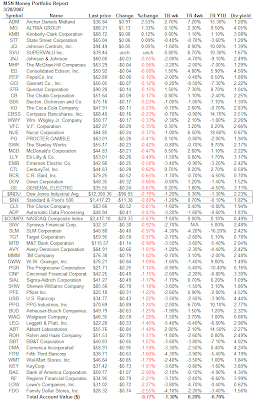

Labels: Dividend Return

Posted by

David Templeton, CFA

at

7:12 AM

0

comments

![]()

![]()

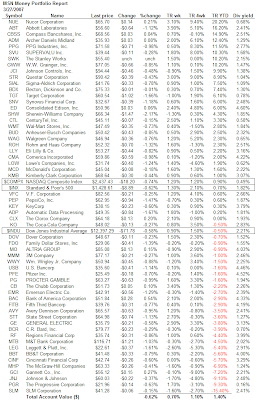

Labels: Investments

Posted by

David Templeton, CFA

at

6:54 AM

0

comments

![]()

![]()

Labels: Technicals

- At the American Association of Individual Investors website: Four Basic Steps to Gauging a Firm's True Financial Position by Jay Taparia, CFA

- Secular Bull and Bear Markets Profile by Crestmont Research. An annotated version of the chart can be found here.

- Trend Macrolytics published an article at Smart Money, The Signs Point to a Correction, Not a Bear Market by Donald Luskin.

- Optionetics Weekly Outlook by Chris Tyler for March 19, 2007 notes: "In light of the recent bearish extremes and patterns in place, bullish opportunities do appear close at hand."

- Geoff Gannon from Gannon On Investing lists headlines and links from Value Investing News

Posted by

David Templeton, CFA

at

11:21 PM

0

comments

![]()

![]()

Labels: General Market

“We are concerned that the large expenditures on buybacks may be inhibiting dividend growth,” continues Silverblatt. “While Standard & Poor’s has yet to see a significant decline in the number of dividend increases, the lack of increases, as well as the absence of new initiations, speaks to the current climate of buyback preference.”

Silverblatt points out that the tendency for index issues to pay and increase cash dividends is much greater than that of the general market as 77% of the S&P 500 constituents pay cash dividends versus just 40% for the non-S&P 500 companies. For 2007, Silverblatt estimates that over 60% of the S&P 500 will increase their dividend payout compared to just 30% for non-S&P 500 companies.

Posted by

David Templeton, CFA

at

8:04 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

9:23 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

7:08 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

7:28 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

"Today's chart illustrates how the stock market has performed during the average pre-election year. Since 1900, the stock market has tended to outperform during the first six to seven months of the average pre-election year. For the remainder of the year, pre-election performance has tended to be choppy. This pre-election year has, for the most part (the main exception being the Shanghai surprise of late February), been true to form."

Posted by

David Templeton, CFA

at

11:42 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

8:06 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

7:47 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

8:19 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

10:39 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

9:21 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:17 PM

0

comments

![]()

![]()

Labels: General Market

Why the differences?A retiree's/investor's allocation to stocks/bonds/cash depends on a number of factors. The article provides a cursory review of some of these factors, for example, time horizon, asset levels, withdrawal rates, and a retiree's health.

The recommendations for a 20% stock allocation most likely come from evidence from historical returns indicating that portfolios containing these stock exposures have a risk that is no higher than an all-bond portfolio, a risk level that is appropriate for a shorter-term time horizon.

The higher recommended stock allocations most likely are based on studies concerning withdrawal rates during retirement.

For example, one recent study found that, for individuals withdrawing funds each year from their portfolio, the probability of not outliving retirement resources was maximized when initial withdrawal rates were kept below 5% (with subsequent withdrawals increasing with inflation). For a 4.5% initial withdrawal rate, the probability was maximized with portfolios consisting of 40% stocks and 60% fixed income (including both bonds and cash) over a 30-year time horizon, while for a 4% initial withdrawal rate, the probability is maximized with an allocation of 30% stocks and 70% fixed income. [For a complete description of this study, see "Bear Market Strategies: Watch the Spending, Hold the Stocks," a study by T. Rowe Price, in the May 2003 AAII Journal].

So, who should you believe—the 20% crowd or the 35% to 40% crowd?

Posted by

David Templeton, CFA

at

9:51 PM

0

comments

![]()

![]()

Labels: Financial Planning

Posted by

David Templeton, CFA

at

6:13 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

9:19 AM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

6:34 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:29 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

7:20 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

6:41 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:12 PM

0

comments

![]()

![]()

Labels: Dividend Return , Technicals

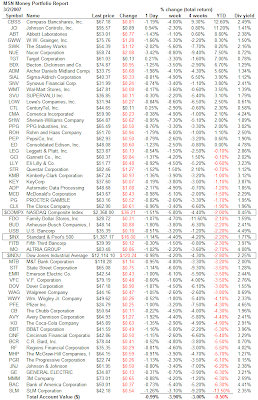

(Note: performance should be is as of March 5, 2007)

Posted by

David Templeton, CFA

at

7:08 AM

0

comments

![]()

![]()

China woes ripple through U.S. markets

What happens in China apparently doesn’t stay in China. A sharp sell-off last week on the Chinese stock market shook up markets all over the world. Every industry group fell as the U.S. market dropped 4.4% during the week. Not every industry suffered equally. Several industries viewed as risky or tightly tied to the economy, such as autos, financials and semiconductors, fell more than 6% for the week. More stable industries, such as utilities, were relatively spared with a 2% weekly decline. Investors will be watching “beige book” reports due this week for clues about the U.S. economy’s health.

Posted by

David Templeton, CFA

at

8:14 AM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

7:36 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

"What makes people want to buy a stock? There are many factors which people consider before purchasing a stock and while we primarily focus on the technicals, there is another group of participants whose focus is on the fundamentals of the company. I am not going to tell you that fundamentals really matter to me, because they don’t. I’m just looking for stocks that will go higher.

There is a large portion of investors who consider fundamentals to be the most important thing to consider before purchasing a stock. To me, the PE ratio is as valuable as the MACD or a moving average. By that I mean that by themselves, they are useless…that’s right, you read it correctly. The value of any market measurement is not in the literal interpretation, but in the correct assessment of determining when they will be considered important enough to a large group of participants to make a decision to buy or sell decision. If a widely followed indicator can be used to clue us to a potential move in a stock we cannot ignore it, that is common sense."

Posted by

David Templeton, CFA

at

6:42 PM

0

comments

![]()

![]()

Labels: General Market , Investments

Posted by

David Templeton, CFA

at

10:06 AM

2

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

9:36 PM

0

comments

![]()

![]()

Labels: Dividend Return

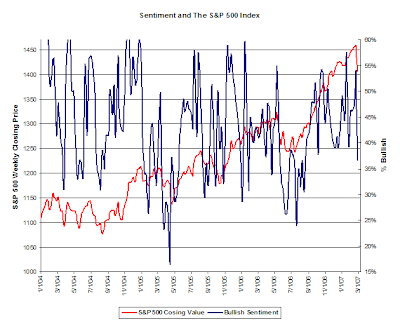

From Chart of the Day:

Investors are very concerned about the future direction of the stock market following Tuesday's significant drop. For some perspective, today's chart illustrates the current trend of the Dow. It is interesting to note that as it currently stands, the Dow has backed off from resistance (red line) and subsequently moved right down to an intermediate term trend line (gray dashed line). So while a sell-off in Shanghai directly influenced markets around the globe, it is worth noting that many of these markets had been rallying themselves and we're exhibiting signs of being overbought.(click on chart for larger image)

Posted by

David Templeton, CFA

at

7:08 AM

0

comments

![]()

![]()

Labels: General Market , Technicals

Posted by

David Templeton, CFA

at

10:00 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

7:04 AM

0

comments

![]()

![]()

Labels: General Market , Technicals