All eyes have been on the Federal Reserve recently as talk of tapering of the quantitative easing programs was introduced by some Fed governors. An outcome of reducing the QE influence on the economy would likely be a move higher in interest rates. In fact, the yield on the 10-year Treasury recently moved higher from the 1.60% area to the 2.20% level as a result of the tapering comments. If this gradual reduction in QE is implemented, interest rates are likely to normalize at a higher level. Rising yields are not necessarily bad for the economy; however, higher rates are likely to have an impact on the value of the U.S. Dollar and commodity prices. There are a number of factors that influence the value of a currency, interest rates though, have a direct impact on a country's currency. As interest rates rise, the dollar tends to strengthen.

|

| From The Blog of HORAN Capital Advisors |

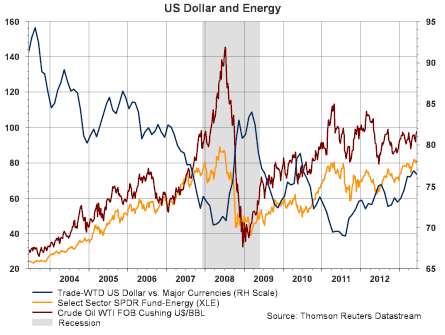

With this strengthening, downward pressure is placed on commodity prices. Some commodities, like oil, are impacted more by the strengthening of the US Dollar as oil is transacted in Dollars around the world. As an example, an oil company in say Norway would receive more Krone for every Dollar converted back to the Norwegian currency in a strong Dollar environment. Because the Norwegian oil company is getting a currency benefit in the exchange, downward pressure is placed on the price of oil. Certainly a country's fiscal situation, along with other factors (Purchasing Power Parity), will impact a currency's value.

|

| From The Blog of HORAN Capital Advisors |

For an investor then, a question becomes what is the impact of a potential rise in interest rates on commodities and commodity centric firms. Also, why is the dollar strengthening? Is the economy strengthening thus resulting in a higher demand for oil? Is this placing downward pressure on energy and commodity supplies which would translate into higher energy prices? The yellow colored line in the above chart represents the energy sector exchange traded fund XLE. It is pretty clear that energy firms are highly correlated with the move in energy prices. If U.S. Dollar strengthening translates into lower oil prices, the energy space could come under downward price pressure.

As the below chart shows from a technical perspective oil prices have moved into a tight pendant pattern. Technically, it isn't clear from the chart in what direction oil prices might move, only that it could break hard in one direction or the other.

|

| From The Blog of HORAN Capital Advisors |

Other direct commodity plays have come under significant price pressures this year as well. Many differing variables are impacting these commodity prices. For the coal related industries (KOL), the significant discoveries of natural gas in the U.S. due to fracking is lessening the demand for coal. Also, lower commodity prices may be indicative of slowing economic growth rates in some of the emerging economies.

|

| From The Blog of HORAN Capital Advisors |

Both the materials sector and the energy sector have been some of the weaker performing sectors in the market this year. Up until last month, the better performing sectors had been the more

defensive and higher yielding ones like health care and consumer

staples. We discussed the potential rotation out of these sectors several weeks back with materials and energy beginning to outperform the broader market at that time.

|

| From The Blog of HORAN Capital Advisors |

Be it right or wrong, the market will be laser focused on the Fed's statement Wednesday in an effort to gain a better understanding of the future direction of interest rate policy. As noted in the link to Scott Grannis' article at the beginning of this post, higher rates are not necessarily a bad omen for the economy. However, future interest rate policy will likely influence these commodity related sectors.

No comments :

Post a Comment