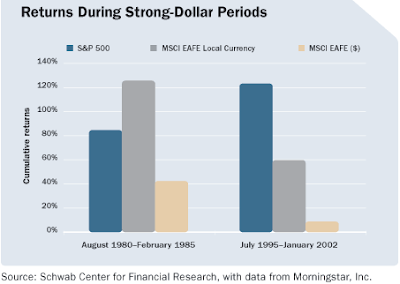

International investments can add a diversification element to an investor's investment portfolio. One factor to keep in mind, however, is the amount of return that results from converting foreign returns back into ones home currency (the U.S. Dollar in this case). The resulting impact on returns during strong dollar periods can drastically reduce realized realized returns as noted in the chart below:

(click on chart for larger image)

A recent research report from Charles Schwab (SCHW) notes EAFE (EFA) returns were larger than S&P 500 Index ($INX) returns during the 1980- 1985 period. However, once the EAFE returns were converted back into the dollar, the returns were far less than the S&P 500 Index.

The 1980–1985 period was an exceptional period for international stocks. In local currencies, the EAFE returned a cumulative 126%—well in excess of the not-too-shabby 85% for the S&P 500. However, most international equity funds don’t hedge their currency exposure, and when returns are converted back into dollars, the EAFE return was cut to 43%. In other words, even though foreign markets did well, U.S. investors would have enjoyed only about one-third of that performance, due to the strengthening dollar. The results were even more dramatic from 1995 to 2002. The rising dollar practically wiped out all of the 60% gain that the countries in the EAFE Index generated in local currencies!

Undoubtedly, the U.S. Dollar has weakened significantly since the end of 2006. Even over the course of the last 10-years, the dollar has trended lower.

(click on chart for larger image)

U.S. Dollar strength and weakness is difficult to predict, but the extended slide over the last few years makes one wonder how much lower can it fall. If the U.S. economy is ahead of world economies from an economic cycle perspective, could dollar strength be around the corner? If the U.S. is poised for an interest rate increase due to anticipated economic strength, this would provide some support for the dollar and result in some strengthening.

In the end, an investor should be aware of the hedging or non-hedging of currencies in their foreign investments.

In the end, an investor should be aware of the hedging or non-hedging of currencies in their foreign investments.

Source:

Too Much Of A Good Thing

Charles Schwab & Co.

By: Mark W. Riepe, CFA

July 17, 2008

http://www.schwab.com/public/schwab/research_strategies/market_insight/investing_strategies/stocks/too_much_of_a_good_thing.html?cmsid=P-2708301&lvl1=research_strategies&lvl2=market_insight&refid=P-1048563&refpid=P-1005231

No comments :

Post a Comment