Recent market commentary has highlighted the weak market breadth in spite of the equity market's continued move higher. Weak market breadth refers to the technical situation where more equity issues are declining than rising. This weakness raises a red flag in an environment where breadth is negative and the equity market continues to move higher. Below are a couple of charts and article links noting the weakness and subsequent returns when this occurred in the past.

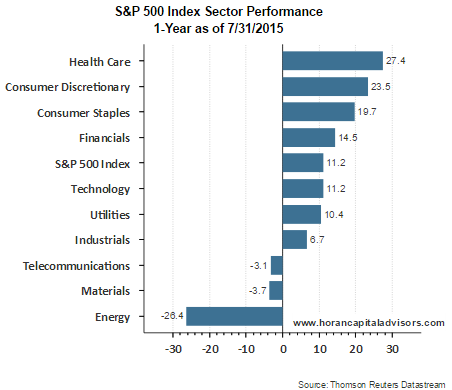

Certainly, the breadth technical picture is something investors should continue to evaluate. However, what is equally, if not more important, are company fundamentals and the valuation level of the overall market. Below are a couple of charts on two market sectors that have attracted a lot of investor attention this year.

The first chart compares the S&P GICS Technology Sector to the forward P/E for the 67 companies that currently make up the sector. As can be seen from the chart, valuations are no where near the sector valuation reach prior to the tech bubble bursting in 2000. In 2000 the PE reached nearly 50 for the sector where today the sector is trading at a PE multiple of just under 15 times earnings.

Another sector that continues to attract investor interest is biotechnology. As the below chart for this sector shows, the biotech index (8 companies) has risen significantly since 2012. In spite of this sustained move higher, the sector PE is just over 17, far below the 2000 peak of 63.

Lastly, even the broader S&P 500 Index itself is not trading at the technology bubble level reached in 2000. The current forward PE is 17 versus the 2000 peak of 24. The current PE is just slightly above its long term average.

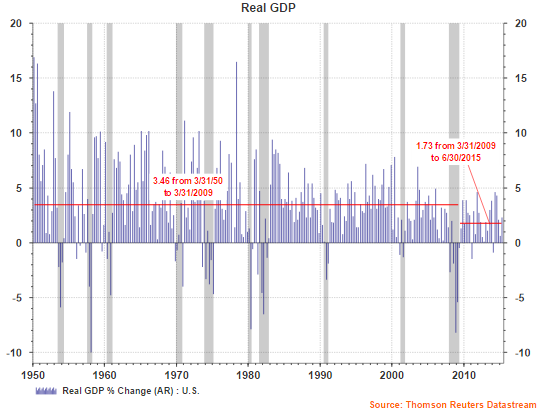

The weak market breadth is a variable investors might want to track, keeping in mind market valuations are far below the levels reached in early 2000. A critical variable will be corporate earnings looking out for the next four quarters. Companies have begun reporting their second quarter results (60 companies reported through 7/17). Earnings growth for the next four quarters is projected to back-end loaded. Thomson Reuters I/B/E/S is estimating Q2 2015 through Q1 2016 quarterly earnings growth will equal: -2%, -1%, 4% and 9%.

And finally, just a brief comment on

individual investor sentiment, which we also review in our just completed Summer Investor Letter. AAII individual investor bullish sentiment was reported at 30.8% last week, which is nearly one standard deviation below the average bullish sentiment level. Two weeks ago the bullish sentiment reading fell to a low 22.6%. This low level of bullishness reported by individual investors is a contrarian indicator. Could the market be positioning itself for a rally to finish off the summer? Ryan Detrick wrote an article today,

Investor Sentiment: Why A Market Correction May Be Slipping Away, that provides a good analysis of other sentiment indicators and what these indicators might suggest for market performance in the coming months.