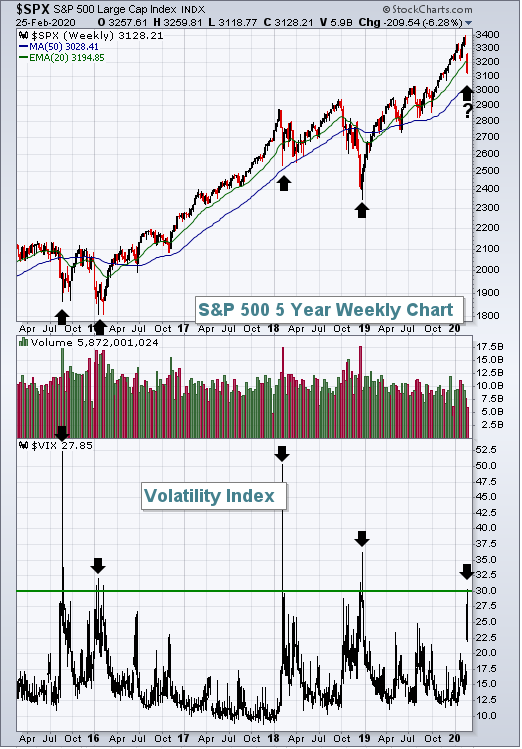

The coronavirus, Covid-19, has triggered the recent decline in the equity market, specifically the S&P 500 Index. The Index is down 8.3% from its February 18 high with six percentage points of the decline occurring in the last two days. In spite of the recent weakness, the S&P 500 Index remains up 17% since the beginning of 2018. Within the S&P 500 Index though, more than 125 stocks are down more the 25% from their 52-week high, potentially providing some individual stock opportunities for investors.

The selloff has seen safe haven assets perform well with bonds attracting some of the cash. The 10-Year U.S. Treasury is now yielding 1.37% and that is down from 1.9% at the beginning of the year. Lower yields may also be an outcome from the market's expectation of a slower economic environment ahead resulting from news surrounding the Covid-19 virus.

Along with lower bond yields, investor fear can be evaluated by looking at the VIX, sometimes referred to as the fear gauge. The VIX has spiked to 27.85 after trading in the low double digits in January. Clearly higher levels of the VIX are possible, but fear/sentiment tends to be a contrarian measure and the equity market has had a history of reversing higher with VIX readings at this level.

Combining the VIX with the 10-year U.S. Treasury Yield incorporates the fear measure with that of a recessionary measure, i.e., the 10-Year U.S. Treasury. This ratio is at 20.9 and above many of the levels where historically the market has turned higher.

CNN Business' Fear & Greed Index is now in the extreme fear range as well.

This time could be different as the selloff is being driven by the uncertainty surrounding the potential economic impact of the coronavirus (Covid-19.) Keeping some perspectives on the situation though, it is estimated 2,700 deaths have occurred from Covid-19 to date. In the 2018/2019 U.S. flu season, 61,200 deaths occurred with 42.9 million people contracting the flu. Of those that contracted the flu, 647,000 required hospitalization.

The consequences and uncertainty around the economic impact of the Covid-19 are factors to pay attention to. However, prior flu seasons in the U.S. have seen substantially higher health consequences versus the Covid-19 virus impact to date. The market remains up a lot when looking at the prior couple of years, but the recent selloff may be nearing a peak.

No comments :

Post a Comment