It seems a day does not go by where the market's valuation is a front and center topic of discussion. Suffice it to say that I believe, and have written as such recently, that the market does not correct simply because it may be trading at an elevated valuation. Although market declines or pullbacks have been few and far between, when the next pullback occurs, a factor in the the magnitude of the decline will likely center on the market's valuation.

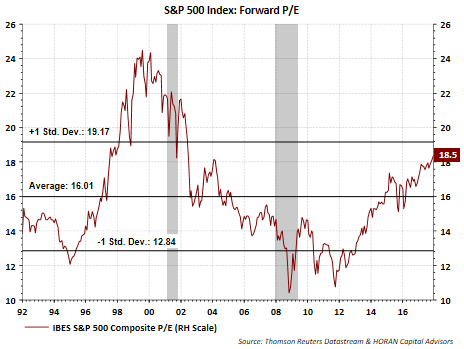

The below chart shows the current market P/E where the earnings are based on the 12-month forward earnings estimate supplied by I/B/E/S. Certainly the P/E is elevated at near a +1 standard deviation level, still the current P/E is quite a bit lower than the technology bubble valuation peak of near 25 times earnings.

Overall earnings growth will be important for the equity market to generate respectable returns in 2018. With passage of a tax reform package nearing realization, companies will benefit from the decline in the maximum corporate tax rate. As an example, tonight FedEx (FDX) reported earnings and noted in the conference call that a lower tax rate will add $.85 to $1.00 to per share earnings. This represents an earnings boost of 8% based on currently expected May 2018 earnings of $12.45 per share. What the tax bill does for many companies is provide an earnings benefit that will result in a reset of the market's valuation to a lower level. The result is the market's valuation is closer to its long run average of 16 to 17 times earnings.

Disclosure: Long FDX

No comments :

Post a Comment