Wednesday, November 29, 2017

Strong Corporate Profit Picture A Key Component In Today's GDP Report

Posted by

David Templeton, CFA

at

9:36 PM

0

comments

![]()

![]()

Tuesday, November 28, 2017

Soaring Consumer Confidence

Posted by

David Templeton, CFA

at

1:23 PM

0

comments

![]()

![]()

Sunday, November 26, 2017

The Sentiment Cycle Phase: "Buy The Dip"

A cycle begins with stocks climbing “a wall of worry,” and ends when there is no worry anymore. Even after the rise tops out, investors continue to believe that they should buy the dips...Unwillingness to believe in that change marks the first phase down: “It’s just another buying opportunity.” The second, realistic, phase down is the passage from bullish to bearish sentiment...Selling begins to make sense. It culminates with the third phase: investors, in disgust,...dump right near the eventual low in the conviction that the bad news is never going to stop…

Posted by

David Templeton, CFA

at

2:44 PM

0

comments

![]()

![]()

Labels: Sentiment , Technicals

Saturday, November 25, 2017

Answering Market Questions Over Thanksgiving

Posted by

David Templeton, CFA

at

5:11 PM

0

comments

![]()

![]()

Labels: Economy , General Market

Sunday, November 19, 2017

NFIB Small Business Optimism Index Highlights Tight Labor Market

- "The tight labor market got tighter for small business owners last month, continuing a year-long trend. Fifty-nine percent of owners said they tried to hire in October, with 88 percent of them reporting no or few qualified applicants."

- "Consumer sentiment surged based on optimism about jobs and incomes, an encouraging development as consumers account for 70 percent of GDP," said NFIB Chief Economist Bill Dunkelberg.

Posted by

David Templeton, CFA

at

9:24 AM

0

comments

![]()

![]()

Saturday, November 18, 2017

Are Bearish Investor Sentiment Responses Translating Into Actual Action?

Posted by

David Templeton, CFA

at

2:47 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment

Sunday, November 12, 2017

Equity Corrections Will Occur Again, Maybe Sooner Than One Expects

Posted by

David Templeton, CFA

at

3:07 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment

Friday, November 10, 2017

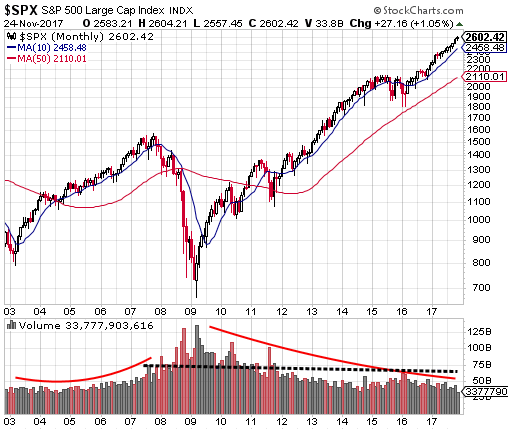

If History Repeating; Another Five Years For Equity Bull Market

Posted by

David Templeton, CFA

at

12:27 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment , Technicals

Thursday, November 09, 2017

Biases Influence Investment Decisions

Posted by

David Templeton, CFA

at

1:25 PM

0

comments

![]()

![]()

Labels: Dividend Analysis , General Market

Monday, November 06, 2017

Investment Opportunities Outside The U.S.

Posted by

David Templeton, CFA

at

5:15 AM

0

comments

![]()

![]()

Labels: General Market , International , Valuation

Sunday, November 05, 2017

Is This The Market Top?

Posted by

David Templeton, CFA

at

12:47 PM

0

comments

![]()

![]()

Labels: Economy , General Market , Sentiment

Thursday, November 02, 2017

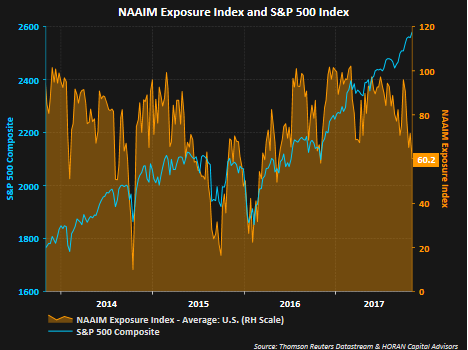

Individual And Investment Manager Sentiment Is Diverging

"is not predictive in nature and is of little value in attempting to determine what the stock market will do in the future. The primary goal of most active managers is to manage the risk/reward relationship of the stock market and to stay in tune with what the market is doing at any given time. As the name indicates, the NAAIM Exposure Index provides insight into the actual adjustments active risk managers have made to client accounts over the past two weeks."

Posted by

David Templeton, CFA

at

11:46 AM

0

comments

![]()

![]()

Labels: Sentiment