S&P Dow Jones Indices recently provided an update on the performance of the S&P 500 Dividend Aristocrats Index compared to the S&P 500 Index. It should be noted the Aristocrats index is an equally weighted index that is rebalanced quarterly. Index members are determined annually based on December year-end information with changes effective at the end of the subsequent January. I have written about the importance of dividends a number of times on this blog and this recent S&P update verifies the important role dividends play in an equity's total return. This post will provide some highlights from the S&P report and readers are encouraged to read the entire research paper.

Although dividends have accounted for a smaller percentage of the the total return for the S&P 500 Index over the past several decades, dividends remain an important component due to the favorable impact dividends have on compounding. As the below chart shows, since 1929 dividends have accounted for over one-third of the return of the S&P 500 Index.

And as the two following charts detail, over a longer period of time, the compounding impact to returns has been significant.

In order for a stock to be considered for inclusion in the Aristocrats Index a company must be a member of the S&P 500 Index and have increased its dividend for a minimum of 25 years. The Index consists of 50 companies and the sector composition relative to the S&P 500 Index is noted below.

The largest sector difference occurs with consumer staples and information technology where the Aristocrats' staples weighting is 26.2% versus 10.1% for the S&P 500 Index and the technology weighting for the Aristocrats is only 1.9% versus 20.6% for the S&P 500 Index.

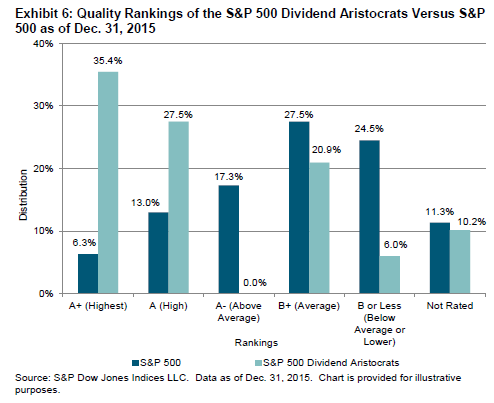

Another unique factor associated with the Aristocrats is the overall Quality Ranking profile is a higher quality one versus the broader S&P 500 Index itself. The importance of this factor is higher quality stocks, tend to be dividend payers, and have the characteristic of holding up better in down markets as the S&P Dividend Aristocrats report covers in detail.

A common variable of higher quality stocks is the fact they pay a dividend and dividend growth companies tend to carry less of a debt load on their balance sheet.

Since I am discussing dividend aristocrats, including a comment on the dividend yield seems appropriate. Of course, the Aristocrats Index basket of stocks carries a higher dividend yield versus the S&P 500 Index, 2.56% versus 2.24%, respectively.

In conclusion, our firm believes dividends are important, with the larger issue being the dividend provides insight into a company's cash flow. It is cash flow that pays the dividend and enables a firm to grow. Consequently, we invest a portion of our clients' portfolios in companies that do not pay a dividend, but do exhibit strong cash flow characteristics. However, analysis around the dividend can provide important signals for investors that may trigger a sell decision. For example, a company may be borrowing in order to maintain a certain dividend growth rate or a company's payout ratio may be increasing. These tangible factors can provide investors with an early warning to companies that may be facing headwinds currently or in the near future.

Source:

S&P 500 Dividend Aristocrats

S&P Dow Jones Indices

By: Smita Chirputkar and Aye M. Soe, CFA

August 2016

No comments :

Post a Comment