|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

4:55 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:16 PM

0

comments

![]()

![]()

Labels: General Market

- the majority of Americans routinely say they will spend about the same as they did the previous year, the 20% saying they will spend less is down from 24% in October 2014, and is the lowest Gallup has recorded for any October since 2007.

|

| From The Blog of HORAN Capital Advisors |

- a third of U.S. adults plan to spend $1,000 or more on gifts and another quarter say they will spend between $500 and $999, while about a third will spend between $100 and $499. Another 3% plan to spend less than $100, while 8% say they will not spend anything.

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

6:35 PM

0

comments

![]()

![]()

Labels: Economy

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:57 PM

0

comments

![]()

![]()

Labels: Commodities

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

1:58 PM

0

comments

![]()

![]()

Labels: Newsletter

|

| From The Blog of HORAN Capital Advisors |

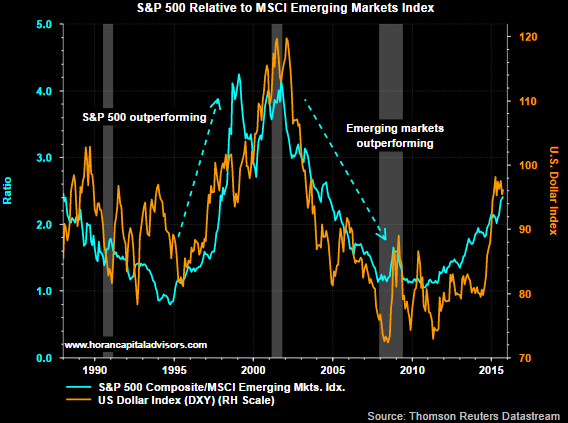

- Outflows from U.S. exchange-traded funds that invest in emerging markets more than doubled last week, with redemptions exceeding $12 billion in the third quarter.

- Withdrawals from emerging-market ETFs that invest across developing nations as well as those that target specific countries totaled $566.1 million compared with outflows of $262.1 million in the previous week.

- The losses marked the 13th time in 14 weeks that investors withdrew money from emerging market ETFs and left the funds down $12.4 billion for the quarter, the most since the first quarter of 2014, when outflows reached $12.7 billion. For September, emerging market ETFs suffered $1.9 billion of withdrawals.

Posted by

David Templeton, CFA

at

11:10 PM

0

comments

![]()

![]()

Labels: International

- "...going back to 1928, the S&P 500 has never been positive year-to-date after being down more than six percent after the third-quarter. The S&P 500 was down 6.74% after the third-quarter in 2015."

- "going back 140 years, every year ending in a "5" has posted a positive return since 1875. In other words, the last 13 years ending in "5" have left stock investors "high-fiving" each other. It is likely mainly due to coincidence, with a healthy dose of positive Presidential Cycle “Year 3″ tailwind mixed in for several of the years. Nevertheless, it is a consistent and compelling track record."

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

3:04 PM

0

comments

![]()

![]()

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

2:40 PM

0

comments

![]()

![]()

Labels: Sentiment

"Higher levels of shareholder return are now part of the market expectation, with many investors anticipating continued high payouts. While companies currently have the resources and low-cost access to funds to continue this trend, once interest rates increase, the higher costs will eventually influence the decision making process for corporate expenditures. Buybacks may be more susceptible to an interest rate hike, given that they are more discretionary and dividend cutbacks are typically seen as a last resort action. Based on the current data, the Q3 actual dividend payment is expected to be the sixth consecutive quarter of new record payments, with Q4 2015 expected to be the seventh."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

10:17 PM

0

comments

![]()

![]()

Labels: General Market