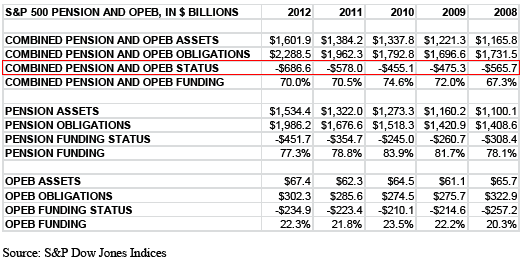

In spite of strong equity market returns over the last four years, company pension fund underfunding continues to increase. For the year ending 2012, the underfunding amount increased to a record level of $687 billion. S&P Dow Jones Indices reports,

"...the amount of assets that S&P 500 companies set aside to fund pensions and OPEB amounted to $1.60 trillion in 2012, covering $2.29 trillion in obligations with the resulting underfunding equating to $687 billion, or a 70.0% overall funding rate."

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Howard Silverblatt of S&P notes in the report that younger workers will need to take more responsibility in saving for their own retirement as companies have shifted more of the retirement funding burden to employees. Beginning to save early is critical in order for younger workers to take advantage of the power of compounding.

Source:

S&P 500 Companies Post Record Level of Pension Underfunding

S&P Dow Jones Indices

By: Howard Silverblatt, Senior Index Analyst

July 31, 2013

No comments :

Post a Comment