At HORAN Capital Advisors, we do believe the market ultimately trades on fundamentals. One difficult part with today's market is the Fed's seemly unlimited intervention with its ongoing Quantitative Easing (QE) programs. This QE activity is anything but a fundamental factor. Global central banks have also jumped on the QE bandwagon with Japan being the latest to announce their QE program. For investors then, it is advantageous to look at short term technical factors in order to provide additional insight into the market's potential future direction. A couple of technical measures are raising warning flags about a potential near term pull back.

- Have we seen the end of the 5th wave pattern in terms of the Elliott Wave parlance?

|

| From The Blog of HORAN Capital Advisors |

Source: The Kirk Report

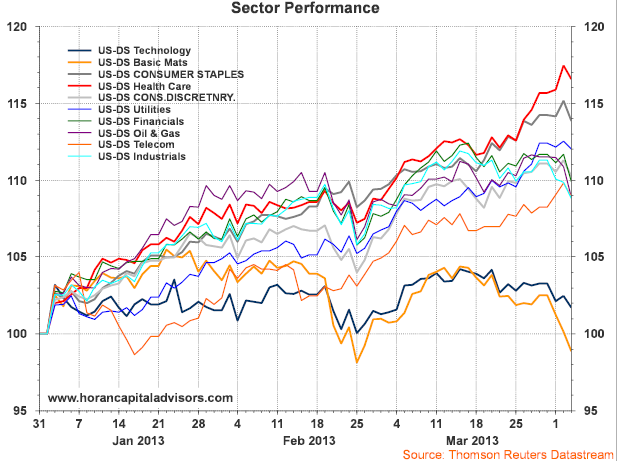

- The defensive sectors, consumer staples and healthcare, have been outperforming the non-defensive sectors, materials, technology and industrials.

|

| From The Blog of HORAN Capital Advisors |

- The small cap stock Russell 2000 Index has been underperforming the large cap S&P 500 Index since mid March. This can also be a sign of a risk off mood of investors.

|

| From The Blog of HORAN Capital Advisors |

- The transport index has been underperforming the broader market since mid march and this could be signaling economic weakness ahead. Additionally, there have been some transport company warnings recently, FedEx (FDX) being one.

|

| From The Blog of HORAN Capital Advisors |

The U.S. market has had a strong advance so far this year and the consensus seems to believe the market is due for a correction. One factor that is almost a certainty in investing is the market does a good job at proving the consensus wrong. As Charles Kirk of the The Kirk Report noted in his after market strategy report this evening, he is focusing on the technical aspects of the market set up,

"While central bankers around the world did their best to restore confidence, concerns over both the economy and upcoming earnings kept the upside limited and big bets on hold at least until the jobs report tomorrow morning. From a technical perspective, we did not see much progress today another than to not be very impressed by the bounce given the significant weakness we have seen this week. Today’s upside once again came on below average volume with mixed leadership and was mostly driven by programs in a thin tape attempting to defend and keep the market from moving lower.

Tomorrow morning will be a busy one due to the jobs report and other econ data. The bears will need to step up their game tomorrow and put some pressure on or the bulls will do what they do best and attempt another reversal back to potentially test if not break through the all time intraday highs at S&P 1576."

No comments :

Post a Comment