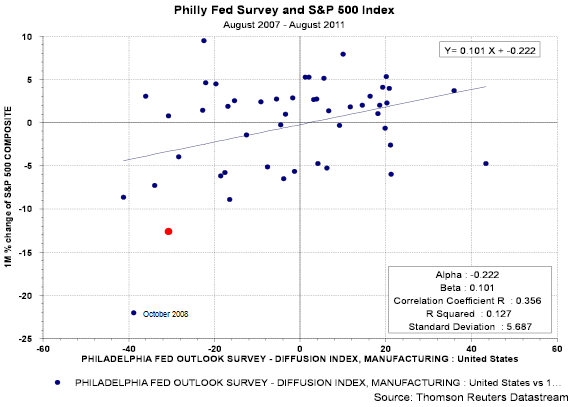

Analyst are extrapolating the weak report for the Philadelphia Fed Outlook on Thursday as a precursor to more stock market weakness. In actuality though, the monthly performance of the S&P 500 Index has a very low correlation to the monthly Philly Fed report. The below chart shows the data from August 2007 through August 2011. The "red" plot point is the August 2011 data.

|

| From The Blog of HORAN Capital Advisors |

As the above chart shows, the monthly Philly Fed report and the monthly return for the S&P 500 Index have a low correlation of .356. Additionally, the R-squared is only .127. The t-statistic is very low as well. The flatness of the best fit line is some indication that the market's performance is not very dependent on the monthly Philly Fed data.

In looking at the one year return for the S&P 500 regressed against the one month Philly Fed data does show a higher correlation, .791 and a higher R-squared of .626. If I compare the data back to 1996, the correlation and R-squared are slightly lower than that show in the below chart. Additionally, the one month S&P return versus monthly Philly Fed report has a very low correlation and low R-squared.

In looking at the one year return for the S&P 500 regressed against the one month Philly Fed data does show a higher correlation, .791 and a higher R-squared of .626. If I compare the data back to 1996, the correlation and R-squared are slightly lower than that show in the below chart. Additionally, the one month S&P return versus monthly Philly Fed report has a very low correlation and low R-squared.

|

| From The Blog of HORAN Capital Advisors |

In a vacuum and in the short term then, this one Fed report is not a good predictor of future market returns. Certainly, the Fed report deserves investor attention; however, this data needs to be balanced against other fundamental company data and other economic data. We do believe the risk of a recession has risen, maybe 50-50 now versus one in three several weeks ago. Issues in Europe and lack of leadership in Washington in dealing with budget and economic issues is weighing negatively on consumer and business sentiment. This negative influence on sentiment can negatively impact future economic activity.

No comments :

Post a Comment