Inflation pressures have been finding their way into commodity prices. Much of this commodity price inflation may be the result of investor speculation; however, commodity price pressures are having an impact on some of the emerging market economies. Inflation has not shown in the U.S. consumer price index, but an increase in the velocity of money may provide investors with insight into future inflation.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

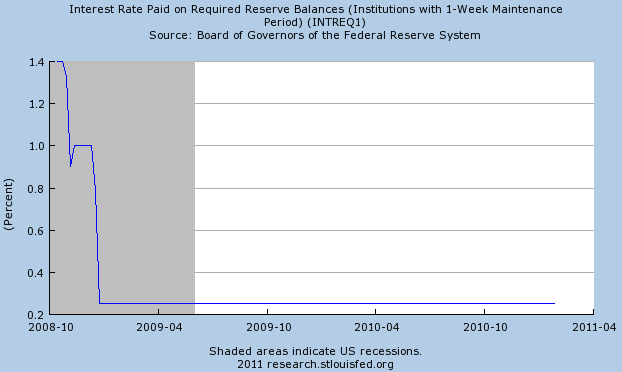

The importance of the relationship between money velocity and inflation is explained by the quantity theory of money. One concern we have at HORAN is the fact banks are sitting on large amounts of deposits/cash at the federal reserve.

|

| From The Blog of HORAN Capital Advisors |

With economic conditions improving, along with banks seeming to get the lending side of their organizations in order, these reserve deposits can quickly find their way into the economy via more relaxed lending standards (increased velocity.) The Fed is doing all it can to stimulate money velocity including a reduction in the interest rate paid to banks on their reserve deposits.

|

| From The Blog of HORAN Capital Advisors |

1 comment :

I find it interesting that the Fed stopped reporting M3 right around the time it would have indicated another huge bubble was in the making. They also keep changing the elements of the CPI in rather misleading ways. It's a shell game to them, where can we hide the problem so nobody sees it. It's very disappointing.

Post a Comment