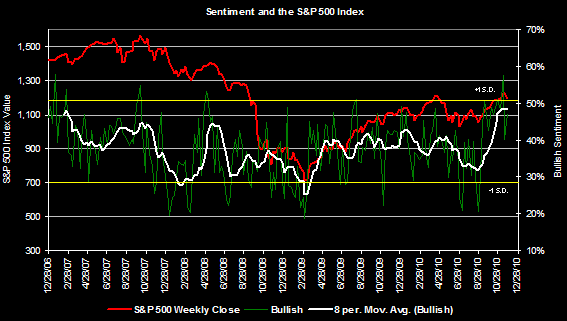

Two weeks ago bullish investor sentiment was reported at its highest level of the year coming in at 57.56%. At the same time the S&P 500 Index hit is yearly high of 1,225. In the following week the bullish sentiment level fell over 17 percentage points to 40% and the market has trended lower since this time. In the latest week the bullish sentiment level has ticked higher to 47.4% with the market trading pretty much in a volatile range.

|

| From The Blog of HORAN Capital Advisors |

Data Source: American Association of Individual Investors

This market volatility seems to be resulting in investors having uncertainty about investing in equities. The below chart shows investors continue to pour money into bond mutual funds at the expense of equity mutual funds. The chart captures data through mid September and the subsequent table contains weekly data for November.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

Table Data Source: ICI

As noted in several earlier posts, one on the recent move in interest rates and the other on potential inflation, investors in long term bonds are taking on duration risk that is likely to result in poor bond returns.

No comments :

Post a Comment