Since 1950 every US recession has been preceded by

- A rise in interest rates

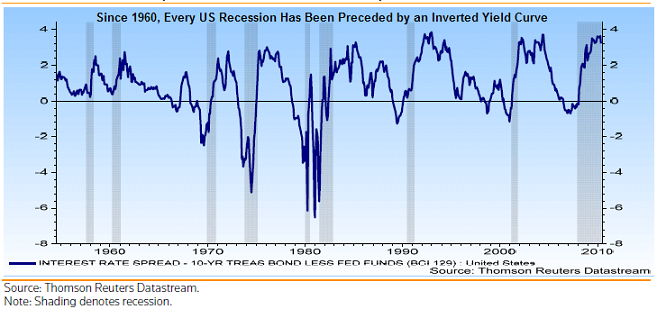

- An inverting yield curve

- Increasing oil prices, and

- Falling unit profits for US nonfinancial companies

None of these factors have occurred as of today as the below charts detail.

No Rise In Rates:

|

| From The Blog of HORAN Capital Advisors |

Yield Curve Not Inverted:

|

| From The Blog of HORAN Capital Advisors |

Oil Prices Stable Last 12-Months:

|

| From The Blog of HORAN Capital Advisors |

Nonfinancial Corporate Profits Moving Significantly Higher:

|

| From The Blog of HORAN Capital Advisors |

So at the moment, a double dip recession does not seem to be the most probable outcome for the economy. We do not see the Fed tightening monetary policy at this point in time. The economic recovery is a fragile one so investors should not throw caution to the wind. We will be evaluating corporate earnings announcement and more importantly corporate earnings guidance for signs that an economic slowdown might be on the horizon.

1 comment :

You're right. There's no sign of a double-dip because we're heading right into a depression.

Us following the Keynesian model is obviously not working and has been disastrous since we followed it.

We're broke and bankrupt!

Post a Comment