|

|

|

| From The Blog of HORAN Capital Advisors |

Economically, there are a number of positives that we will touch on in our second quarter newsletter. The two biggest negatives though are housing and employment.

|

|

|

| From The Blog of HORAN Capital Advisors |

Posted by

David Templeton, CFA

at

9:37 PM

0

comments

![]()

![]()

Labels: Economy , General Market , Technicals

|

Posted by

David Templeton, CFA

at

10:09 AM

0

comments

![]()

![]()

Labels: General Market , Technicals

Posted by

David Templeton, CFA

at

10:19 PM

0

comments

![]()

![]()

Labels: Economy

|

"The number of leading indicators rising on a one-month basis fell significantly from seven out of 10 in March to four out of 10 in April (see Exhibit 3, right). On a more sustained six-month basis, eight out of 10 indicators rose in April—the same as the prior month. The declines on a one month basis were relatively small for all of the leading indicators except building permits, which fell 12% in April from the prior month--a sign of continued stress in the residential housing markets. However, continued strength on a six-month basis and mixed messages on a one-month basis could be indicative of the economy moving into the mid-cycle stage of economic recovery (emphasis added).

While leading indicators tend to rise in near unison immediately following recessions, interpreting them becomes more difficult as the economic recovery gains footing because these indicators tend to rattle around in a more volatile manner. The Conference Board combines these 10 leading indicators into a weighted Leading Economic Indicators (LEI) index that helps paint a broader picture than any one of its subcomponents. As an economic recovery develops, it is helpful to observe these leading indicators alongside other data to gauge a recovery’s strength. The Coincident Economic Indicators (CEI) Index, which helps to gauge current economic conditions as opposed to the leading nature of LEI, is suitable for this purpose."

Posted by

David Templeton, CFA

at

10:03 PM

0

comments

![]()

![]()

Labels: Economy

"...my concern about long-run inflation comes not from the expansion of the Fed's balance sheet, but instead from worries about the ability of the U.S. government to fund its fiscal expenditures and debt-servicing obligations as we get another 5 or 10 years down the current path"

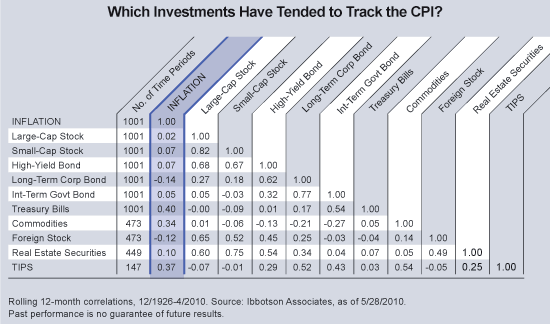

"In theory, a perfect inflation hedge would be an investment whose price moves in the same direction, at the same time, and by the same amount as changes in the consumer price index. Of course, there is no perfect inflation hedge, and while past performance is no guarantee of future success, some asset types have been more successful than others. For a successful hedging strategy, an investment’s return should increase at least as much as and at about the same time as the increase in inflation—or the time lag should at least be measured in months rather than years. Whereas building in protection against inflation over the long haul requires a more holistic approach and a consideration of what asset types have tended to do best in different inflationary environments."

|

|

Posted by

David Templeton, CFA

at

4:02 PM

0

comments

![]()

![]()

Labels: Commodities , Economy , General Market

"...even on an inflation-adjusted basis, gold prices are higher now — two standard deviations above their long-term averages —than they've been since the early 1980s, when the U.S. was experiencing double-digit inflation. The metal is also “out of whack” with other commodities, a trend which has caused some puzzlement, even in places like the Federal Reserve."

|

Posted by

David Templeton, CFA

at

6:34 PM

0

comments

![]()

![]()

Labels: Commodities , Technicals , Valuation

"...nonfinancial companies had socked away $1.84 trillion in cash and other liquid assets as of the end of March, up 26% from a year earlier and the largest-ever increase in records going back to 1952. Cash made up about 7% of all company assets, including factories and financial investments, the highest level since 1963."

|

|

Posted by

David Templeton, CFA

at

8:51 AM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

10:06 AM

0

comments

![]()

![]()

Labels: Investments

...if one removes the impact of deficit spending, "the economy has recovered to the point where the year-over-year growth rate since early 2009 now matches the worst performance of any of the 50 years preceding the recent downturn." In effect, Wall Street's is seeing "legs" where the economy is in fact walking on nothing but crutches.

Posted by

David Templeton, CFA

at

11:24 PM

0

comments

![]()

![]()

Labels: Economy , General Market

"The bearish forecasters who rose to fame in the market crash of 2008 have, for the most part, not surrendered their pessimism. Their moment could be coming back around..."

|

"Last week, the Dow Jones Industrial Average rose above 10000—again. Since March 16, 1999, when it first touched 10000 in intraday trading, the Dow has bounced over that threshold and back 63 times. This Friday (6/11/10), the index closed 219.6 points below where it stood exactly 11 years ago."

"in my nearly 50 years of experience in Wall Street, I've found that I know less and less about what the stock market is going to do but I know more and more about what investors ought to do."

Posted by

David Templeton, CFA

at

9:53 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Today, companies are in a position to once again focus on growing their dividends for several reasons."A dividend-oriented strategy has to be looked at over market cycles—there are times when it will lag, typically coming off a market correction or recession, and times when it does relatively well, usually in periods of market turbulence."

- Strong Balance Sheets: Many companies are flush with cash. A recent Wall Street journal article noted, "U.S. companies are holding more cash in the bank than at any point on record, underscoring persistent worries about financial markets and about the sustainability of the economic recovery. The Federal Reserve reported Thursday that nonfinancial companies had socked away $1.84 trillion in cash and other liquid assets as of the end of March, up 26% from a year earlier and the largest-ever increase in records going back to 1952. Cash made up about 7% of all company assets, including factories and financial investments, the highest level since 1963."

- Sluggish Growth: In periods of slow economic and earnings growth dividends become a more critical part of the total return of a particular company's stock. In this environment companies are likely to respond to the investor's desire for more income from their equity investments. Since 1925, reinvested dividends have accounted for almost 44% of the total return of the S&P 500 Index.

- Less Volatility: Dividend paying stocks tend to be less volatile during downside market volatility. One factor we believe that will be present in the investment markets for the foreseeable future is a more volatile investing climate. A recent T. Rowe Price report notes, "dividend-paying stocks in the S&P 500 outperformed nondividend payers in every bear market since 1973 but tended to lag in bull markets, according to Ned Davis Research (NDR), a market research firm.

During the bear market from March 24, 2000, to October 9, 2002, the S&P 500 plummeted 49.1%, while the Dividend Aristocrats gained 15.5%, according to Strategas Research Partners, another market research firm. In the recent market decline from October 2007 to March 2009, the Aristocrats declined 49.6%, compared with 56.8% for the S&P 500."

- Long-Term Performance: "NDR calculates that from 1972 through March 31, companies in the S&P 500 that have consistently increased or started making their dividend payouts provided an annualized return of 9.4%, compared with 7.3% for companies that paid dividends but did not increase them and only 1.5% for non-dividend-paying stocks."

- Steady Cash Flow: "From 1980 through 2009, dividends on stocks in the S&P 500 grew at an annual compound rate of 4.7% compared with the 3.7% annual inflation rate."

Over a longer time period, principal growth of an equity portfolio outpaces that of a fixed income portfolio as well. The T. Rowe Price article cites a Ned Davis Research study showing this performance difference.

"NDR tracked the performance of two portfolios over the past 25 years. One consisted of the top 50% of dividend payers in the S&P 500. The other was the S&P Long-Term Government Bond Index. The study assumed all interest and dividend payments were taken in cash each year.

Assuming a $500,000 initial investment in each portfolio at the end of 1984, the equity index provided total dividend payments of more than $2.6 million through 2009, or about $212,000 more than the total interest payments from the bonds. Moreover, in terms of principal value, the original $500,000 investment in the stock portfolio grew to more than $2.8 million compared with about $908,000 in the bond portfolio."

|

Posted by

David Templeton, CFA

at

3:08 PM

0

comments

![]()

![]()

Labels: Dividend Return , Investments

|

|

|

Posted by

David Templeton, CFA

at

11:32 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

|

Posted by

David Templeton, CFA

at

9:52 PM

0

comments

![]()

![]()

Labels: Dividend Return

|

|

Posted by

David Templeton, CFA

at

1:23 AM

2

comments

![]()

![]()

Labels: General Market , Technicals

"The chart below depicts (on the right axis) the gap between the yields on the benchmark 10-year Treasury note and the S&P 500. Plotted against this series is the performance gap between the return on the S&P 500 and the return on the 10-year Treasury over the subsequent 12-month period.

Generally, a yield gap of 400 basis points or less has proven bullish for stocks. More notable, however, is that extreme levels have been very predictive of the market’s future direction. For example, the yield gap peaked in the fourth quarter of 1999 at 535 basis points, accurately foreshadowing that stocks were quite overvalued relative to bonds. Alternatively, in March of 2003 the gap had shrunk to just 150 basis points as bond yields had plunged and stock prices had sunk to bear market lows (thus pushing up dividend yields). The current readings are even below the March 2003 levels, suggesting that stocks are quite undervalued."

|

Posted by

David Templeton, CFA

at

9:30 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

|

"In general, you want to follow the smart money traders—tracking indicators such as commercial hedger positions and the S&P 100 index (OEX) put/call and open interest ratios. In contrast, you want to do the opposite of what the dumb money traders are doing—tracking indicators such as the equity-only put/call ratio, flows into and out of the Rydex series of funds and small speculators in equity index futures contracts.

As the old adage goes, markets can stay irrational longer than you can stay solvent, so I’m not here to judge the precise end to this correction. As we’ve noted, the market had been overdue for another pullback, one likely to be less benign than those that preceded it in light of stretched technical and sentiment conditions. In fact, it’s usually soon after the first year of a new bull market (cyclical or secular) that the market experiences its first 10%-15% correction."

Posted by

David Templeton, CFA

at

8:54 PM

0

comments

![]()

![]()

Labels: Technicals