Sunday, February 28, 2010

Dividends Will Be A Company's Renewed Focus?

Posted by

David Templeton, CFA

at

10:48 PM

0

comments

![]()

![]()

Labels: Dividend Return

Saturday, February 27, 2010

Berkshire Hathaway's 2009 Annual Letter Is Out

Posted by

David Templeton, CFA

at

10:38 AM

1

comments

![]()

![]()

Labels: General Market

Thursday, February 25, 2010

The Impact Of Rising Interest Rates On Stocks And Bonds

It should be noted longer term market rates have already been trending higher over the past twelve months. The 30-year U.S. Treasury rate has increased from around 3.5% a year ago to 4.6% today. Short term rates, i.e., the 1-month Treasury rate, has actually declined from around .20% a year ago to .08% today. In other words the yield curve has steepened. But back to the original question.

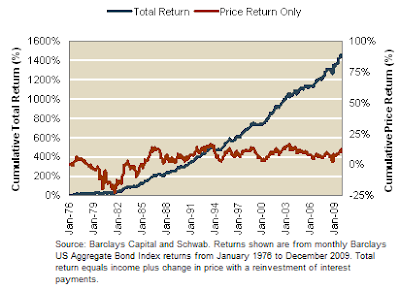

For a bond investor, higher interest rates will have a negative impact on the price of a bond or price of a bond mutual fund. The impact of this "interest rate risk" depends on the maturity or duration of a particular bond. In its simplest form, the duration indicates how much the price of a bond or price of a bond mutual fund will change given a 1% or 100 basis point change in interest rates. For example, if the duration of the bonds in a bond mutual fund is 5 years, then the price (NAV) of the bond fund will decline 5% (increase) for a 100 basis point increase (decrease) in interest rates. The question for investors then is how long does it take to recover the loss in principal.

In a recent research article from Charles Schwab (SCHW) titled, Should You Worry About Bond Funds if Interest Rates Rise?, it is noted that,

"More than 90% of the total return since 1976 generated from a broadly balanced portfolio of US investment-grade Treasury, agency and corporate bonds has come from interest payments as opposed to change in price..."

If an investor understands the recovery time, they will then know if their time horizon matches the term or duration of the bonds or bond fund.

If an investor understands the recovery time, they will then know if their time horizon matches the term or duration of the bonds or bond fund. For stocks they tend to perform better in declining interest rate environments as well. Unlike bonds though, on average, stocks have generated positive returns in rising interest rate environments as well as in declining rate environments. Although stock returns have tended to be positive in periods where interest rates have increased, the better returns are found in declining interest rate periods.

For stocks they tend to perform better in declining interest rate environments as well. Unlike bonds though, on average, stocks have generated positive returns in rising interest rate environments as well as in declining rate environments. Although stock returns have tended to be positive in periods where interest rates have increased, the better returns are found in declining interest rate periods. In Standard & Poor's article, Rising Rates Revisited, they include returns be S&P 500 sector as well.

In Standard & Poor's article, Rising Rates Revisited, they include returns be S&P 500 sector as well.For investors then, if one believes interest rates will trend higher over a period of time in which it will be necessary to access the principal invested, paying attention to the duration of an investment as well as the types of stocks within a portfolio will be important.

Source:

Should You Worry About Bond Funds if Interest Rates Rise?

Charles Schwab & Co.

By: Rob Williams

February 24, 2010

http://tinyurl.com/ylbmaeu

Rising Rates Revisited

Standard & Poor's

By: Sam Stovall

February 19, 2010

http://tinyurl.com/23j6med

Posted by

David Templeton, CFA

at

7:26 PM

0

comments

![]()

![]()

Labels: Bond Market , General Market

Sunday, February 21, 2010

Investor Fund Flows Favoring Fixed Income Investments

The chart shows fixed income funds have generated positive investment flows since September of last year. During that same time period, equity funds saw outflows except for a brief period in early January of this year. The negative flow in money market cash has been driven mostly by institutional investors. Retail investors have actually added to their money market funds since the beginning of February. Is this a contrarian sign?

|

Posted by

David Templeton, CFA

at

8:23 PM

0

comments

![]()

![]()

Labels: General Market , Sentiment

Wednesday, February 17, 2010

2010 Dogs Of The Dow Performance Update

|

Posted by

David Templeton, CFA

at

11:05 PM

0

comments

![]()

![]()

Labels: Investments

Sunday, February 14, 2010

4 Dividend Increases Earlier This Month

|

Sigma-Aldrich (SIAL)

- announced a 10.3% increase in the quarterly dividend to 16 cents per share versus 14.5 cents per share in the same quarter last year.

- based on 2010 estimated earnings per share of $3.14, the projected payout ratio is 20%. This compares to the 5-year average payout ratio of 20%.

- SIAL carries an S&P Earnings & Dividend Quality Ranking of A+ and is one of S&P's Dividend Aristocrats.

|

United Technologies (UTX)

- announced a 10.4% increase in the quarterly dividend to 42.5 cents per share versus 38.5 cents per share in the same quarter last year.

- based on 2010 estimated earnings per share of $4.60, the projected payout ratio is 37%. This compares to the 5-year average payout ratio of 27%.

- UTX carries an S&P Earnings & Dividend Quality Ranking of A+.

|

Archer-Daniels Midland (ADM)

- announced a 7.1% increase in the quarterly dividend to 15 cents per share versus 14 cents per share in the same quarter last year.

- based on June 2010 estimated earnings per share of $2.96, the projected payout ratio is 20%. This compares to the 5-year average payout ratio of 18%.

- ADM carries an S&P Earnings & Dividend Quality Ranking of A and is one of S&P's Dividend Aristocrats.

|

Bemis (BMS)

- announced a 2.2% increase in the quarterly dividend to 23 cents per share versus 22.5 cents per share in the same quarter last year.

- based on 2010 estimated earnings per share of $1.92, the projected payout ratio is 48%. This compares to the 5-year average payout ratio of 49%.

- BMS carries an S&P Earnings & Dividend Quality Ranking of B+ and is one of S&P's Dividend Aristocrats.

|

Disclosure: Long interest in UTX.

Posted by

David Templeton, CFA

at

9:50 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Saturday, February 13, 2010

The Value Is In Quality

"S&P believes that high-quality stocks offer both increased safety of principal and potentially higher long-term returns versus low-quality issues,” says Richard Tortoriello, an S&P equity analyst. “We believe the recent market pull-back offers investors an opportunity to participate in a cyclical bull market. We would favor high-quality issues at this point."

A partial list of the stocks that carry S&P's 4 or 5 STAR rating and also have a buy rating by an S&P analyst is detailed below.

|

Disclosure:

Readers should assume I have a long interest in each company on the above list and/or may be selling an investment in one or more of the above companies at anytime.

Posted by

David Templeton, CFA

at

1:41 PM

0

comments

![]()

![]()

Labels: Investments

Thursday, February 11, 2010

Conflicting Investor Sentiment Data

"bullish sentiment among newsletter writers is currently at 34.1%, which is the lowest level since March 2009. At the same time, bearish sentiment (26.1%) is the highest since November, while the percentage of newsletter writers in the correction camp has sky-rocketed all the way to 39.8%, which is a level that hasn't been seen since 1983," as reported by Bespoke Investment Group.

|

Posted by

David Templeton, CFA

at

11:33 PM

0

comments

![]()

![]()

Labels: Sentiment

Tuesday, February 09, 2010

S&P 500 Index Finding Support

The market continues to look for direction in the face of the negative news related to sovereign debt issues in Greece. Today's market advance came on the back of a potential resolution of the debt crisis with the EU maybe stepping in to provide some support. The downside to this is the lack of moral hazard. As noted in a recent issue of The Economist magazine,

"A messy Greek default would harm almost everybody. As markets and governments know only too well, behind Greece stand others: Portugal, Ireland, Spain and even Italy, the world’s third-biggest sovereign debtor."

|

|

Posted by

David Templeton, CFA

at

9:44 PM

0

comments

![]()

![]()

Labels: General Market , Technicals

Sunday, February 07, 2010

Catching Up On A Few Dividend Increases From Last Week

L-3 Communications

- announced a 14% increase in the quarterly dividend to 40 cents per share versus 35 cents per share in the same quarter last year.

- based on 2010 estimated earnings per share of $8.15, the projected payout ratio is 20%. This compares to the 5-year average payout ratio of 16%.

- LLL carries an S&P Earnings & Dividend Quality Ranking of A-.

|

Colgate-Palmolive

- announced a 20% increase in the quarterly dividend to 53 cents per share versus 44 cents per share in the same quarter last year.

- based on 2010 estimated earnings per share of $4.85, the projected payout ratio is 45%. This compares to the 5-year average payout ratio of 45%.

- CL carries an S&P Earnings & Dividend Quality Ranking of A+.

|

Posted by

David Templeton, CFA

at

5:26 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Thursday, February 04, 2010

Decline In Bullish Investor Sentiment Continues

|

Posted by

David Templeton, CFA

at

7:00 AM

0

comments

![]()

![]()

Labels: Sentiment

Tuesday, February 02, 2010

Dividend Payers Outperform Non Payers In January

Source: Standard & Poor's

Source: Standard & Poor's

Posted by

David Templeton, CFA

at

10:41 PM

0

comments

![]()

![]()

Labels: Dividend Return