I was driving home tonight listening to Jim Cramer's Mad Money on XM Radio when he was pounding the table on dividend paying investments. As readers of my blog know by now, I am certainly a strong proponent of dividend growth stocks. One of the recommended investments Jim cited for a worthwhile investment because of its 7.6% yield was Blackrock's Dividend Achievers Trust (

BDV). What Jim unfortunately did not mention was this yield was not all income yield.

Some investments distribute both principal (an investor's capital) and income to its investor on a regular basis. For

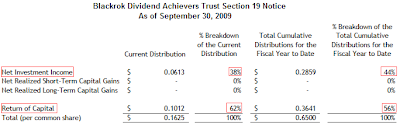

Blackrock's Dividend Achievers Trust, the "income yield" is only 3.46% and the "distribution yield" is 7.67% as of November 30, 2009. The difference between the two yields is the return of an investor's investment in the fund so should it really be counted as income? Personally, I don't think so. Below is a table taken from Blackrock's Section 19 Notice for the Dividend Achievers Fund.

(click to enlarge)

"The last challenge that I would like to discuss with you today involves disclosures associated with a fund's yield or its managed distribution plan. Closed-end funds sometimes tout a high, level dividend or a managed distribution plan to investors. Investors may incorrectly believe that the dividend rate is "yield," i.e., earned income or gain. In fact, the dividend rate often includes a return of capital (emphasis added). As directors, you must make sure that the fund's disclosures explain what the distribution yield represents and what it does not represent and that it is not confused with the fund's actual performance. In particular, if a fund with a managed distribution plan does not earn enough income to sustain a distribution, it must be clear that distributions to investors may be paid from a return of capital which has the effect of depleting the fund's assets. Moreover, in exercising your oversight, you should carefully consider whether managed distribution plans continue to be in the best interests of the fund and its shareholders.

Let me highlight one additional managed distribution plan disclosure issue for your consideration. As you know, funds are required under Rule 19a-1 to provide notice when distributions include a return of capital. In reviewing these notices, my staff has found inconsistencies between 19a-1 notices and other information posted on a fund's website. In particular, the 19a-1 notices show the return of capital while other charts on a fund's website show distributions consisting of all income. Funds have indicated to us that the reason for any differences is because the disclosures are prepared under different bases with 19a-1 notices disclosing book values and other disclosures based on tax considerations. However, fund websites do not always include an explanation discussing why the information is inconsistent in different online sections. Accordingly, I suggest that you review your fund's disclosures to make sure that the information is disclosed consistently and, if not, that the reason or reasons for any inconsistencies are adequately explained to investors."

For investors, be sure to review an investment and ascertain what comprises its yield. In addition to these Section 19 distributions, some funds use leverage in an attempt to increase a fund's yield. This increased leverage might not be so good when interest rates begin to rise and cut into the actual "income yield" for a particular fund. So don't chase an investment based solely on its yield.

As the above chart shows, P&G has generated a flat return on a price only basis versus a return in excess of 20% for the S&P 500 Index. As investors then, for 2010, look for opportunities in higher quality stocks that have not participated in this mostly lower quality stock rally of 2009.

As the above chart shows, P&G has generated a flat return on a price only basis versus a return in excess of 20% for the S&P 500 Index. As investors then, for 2010, look for opportunities in higher quality stocks that have not participated in this mostly lower quality stock rally of 2009.