Efficiently functioning credit markets are integral to sustaining growth for the economy. Certainly, the Fed and Treasury are doing their part in pushing this improvement forward. There will be consequences down the road, i.e., higher inflation? For the time being though, getting the economy (GDP) growing again is the Fed's primary goal.

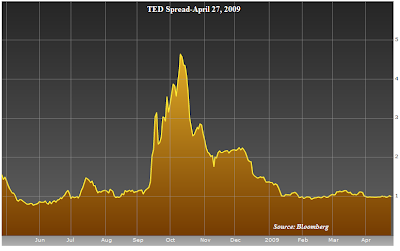

The TED spread, the difference between 3-month LIBOR and the 3-month Treasury bill rate, has narrowed significantly from its peak in October of last year.

The TED spread, the difference between 3-month LIBOR and the 3-month Treasury bill rate, has narrowed significantly from its peak in October of last year.

(click to enlarge)

One outcome of the improved credit markets has been an improvement in the performance of high yield debt. One measure of the high yield debt market is the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). High yield bonds tend to have volatility characteristics not to dissimilar from stocks. The recent improvement in the performance of the HYG ETF is also an indication of a better functioning credit market.

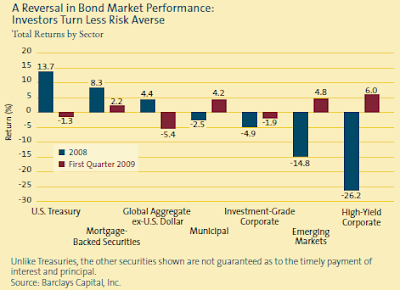

One outcome of the improved credit markets has been an improvement in the performance of high yield debt. One measure of the high yield debt market is the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). High yield bonds tend to have volatility characteristics not to dissimilar from stocks. The recent improvement in the performance of the HYG ETF is also an indication of a better functioning credit market. And what a difference a year makes. The high yield market was one of the worst performing segments of the fixed income markets in 2008, but, the first 3 months of this year have high yield leading the fixed income performance segment.

And what a difference a year makes. The high yield market was one of the worst performing segments of the fixed income markets in 2008, but, the first 3 months of this year have high yield leading the fixed income performance segment.(click to enlarge)

Source: T. Rowe Price Report (pdf)

Source: T. Rowe Price Report (pdf)And lastly, a look at some spread data.

Source: Dallas Federal Reserve (pdf)

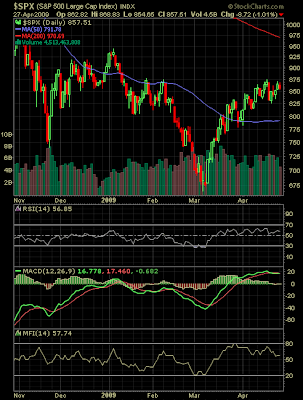

Source: Dallas Federal Reserve (pdf)The economy could certainly be at an inflection point where "less bad" economic data is viewed as a positive. In other words the rate of change or second derivative of a number of data points is now positive. If the economy continues to show improvement, just maybe, stocks can finish the year in positive territory. That is not to say their won't be pullbacks along the way. The market has bounced hard off the early March lows.

(click to enlarge)

But, if an investor is looking for some "equity like" diversification, high yield might be considered as a part of ones investment portfolio.

But, if an investor is looking for some "equity like" diversification, high yield might be considered as a part of ones investment portfolio.(Disclosure: I hold a long position in HYG)

No comments :

Post a Comment