Posted by

David Templeton, CFA

at

11:53 PM

0

comments

![]()

![]()

Labels: Technicals

McCormick & Co. (MKC) announced a 10% increase in its quarterly cash dividend today. The new quarterly dividend increases to 22 cents per share versus 20 cents per share in the same quarter last year. The projected payout ratio equals 41% based on November 2008 estimated earnings of $2.11 per share. The historical 5-year average payout ratio equals 38%.

McCormick & Co. (MKC) announced a 10% increase in its quarterly cash dividend today. The new quarterly dividend increases to 22 cents per share versus 20 cents per share in the same quarter last year. The projected payout ratio equals 41% based on November 2008 estimated earnings of $2.11 per share. The historical 5-year average payout ratio equals 38%.

Posted by

David Templeton, CFA

at

10:19 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:03 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

"buybacks boost EPS above the level that underlying organic growth in net income would on its own." The BCG report notes, "that EPS growth is not necessarily a differentiator of multiples. And when it is, investors are extremely sensitive to how the EPS is delivered."

"buybacks boost EPS above the level that underlying organic growth in net income would on its own." The BCG report notes, "that EPS growth is not necessarily a differentiator of multiples. And when it is, investors are extremely sensitive to how the EPS is delivered."

Posted by

David Templeton, CFA

at

10:55 AM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

9:24 AM

0

comments

![]()

![]()

Labels: Technicals

Introduced by Nobel Prize winner Harry Markowitz in the 1950s, modern portfolio theory proposes that investors may minimize market risk for an expected level of return by constructing a diversified portfolio. Modern portfolio theory emphasizes portfolio diversification over the selection of individual securities. A simplified version of modern portfolio theory is "Don't put your eggs in one basket". Modern portfolio theory established the concept of the "efficient frontier." An efficient portfolio, according to modern portfolio theory, is one that has the lowest risk for a given level of expected return. An underlying concept of modern portfolio theory is that greater risk is associated with higher expected returns. To construct a portfolio consistent with modern portfolio theory, investors must evaluate the correlation between asset classes as well as the risk/return characteristics of each asset.

Posted by

David Templeton, CFA

at

9:21 PM

0

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

9:47 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Standard & Poor's has added a site containing data on home prices in select markets in the U.S. The quarterly information is a summary from the S&P/Case Shiller Home Price Survey.

The purpose is to measure the average change in single-family home prices in a particular geographic market. The monthly indices cover 20 major metropolitan areas, which are also aggregated to form two composites – one an aggregation of 10 of the major metropolitan areas; the other including all 20.

Posted by

David Templeton, CFA

at

7:43 AM

0

comments

![]()

![]()

Labels: General Market

- Since 1900, the stock market has tended to outperform during the first six to seven months of the average pre-election year. For the remainder of the year, pre-election performance has tended to be choppy and flat.

- Going forward, the pre-election year has tended to end the year with a small rally beginning around the time of the Thanksgiving holiday.

Posted by

David Templeton, CFA

at

10:45 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

8:51 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

6:01 AM

0

comments

![]()

![]()

Labels: Technicals

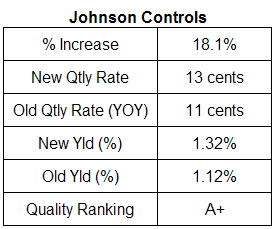

Today, Johnson Controls (JCI) announced an 11.1% increase in the company's quarterly dividend. The new quarterly dividend will equal 13 cents per share versus 11 cents per share in the same quarter last year. This increase represents the 33rd consecutive year that JCI has increased its annual dividend. The payout ratio is 21% based on estimated 9/30/2008 earnings of $2.53. This is in line with the 5-year payout ratio of 21%.

Posted by

David Templeton, CFA

at

8:03 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

"The company is adopting a new strategic objective, implementing role-based portfolio management and more rigorous strategic planning, and narrowing its focus by eliminating over one-fifth of its portfolio. Leggett also intends to enhance returns on its remaining assets, return more cash to shareholders, and pursue disciplined growth."

Posted by

David Templeton, CFA

at

12:04 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

1:04 PM

0

comments

![]()

![]()

Labels: General Market

Posted by

David Templeton, CFA

at

10:29 PM

0

comments

![]()

![]()

"output and employment grow, but not quickly enough to prevent the unemployment rate from rising. That would mean real gross domestic product (GDP) growth of roughly 2%, a modest diminution of inflation pressures, and flat corporate profits through the end of 2008."

reduce real GDP growth by roughly 0.6% in the year ending June 2008, compared with a full percentage point drag over the four quarters ended in June 2007.

Posted by

David Templeton, CFA

at

9:04 PM

0

comments

![]()

![]()

Labels: Economy

Posted by

David Templeton, CFA

at

7:06 PM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

11:09 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Justice David Souter was also critical of the challenge and worried aloud about disrupting the municipal bond market. "We have an enormous market, the effect of interrupting which we really as a court cannot tell very much (emphasis added)," Justice Souter said.

Samuel Alito questioned whether states should be allowed to give special tax breaks on bonds that finance private construction, rather than a government project. So-called private activity bonds finance mortgages, student loans, small-scale industrial projects and redevelopments.

Posted by

David Templeton, CFA

at

9:46 PM

0

comments

![]()

![]()

Labels: Bond Market

The dividend paying stocks in the S&P 500 Index underperformed their non-paying counterparts in the month of October. The payers October monthly return equaled 2.34% versus the non-payers return of 2.84%. On a year to date basis, the payers lagged the non-payers as well, 6.01% versus 7.13%, respectively. A large part of the underformance can be attributed to the weak results from the financial sector. The financial sector weighting in the S&P 500 is nearly 19% of the index. During October the financial sector declined -1.99% versus an overall index return of 1.48%.

The dividend paying stocks in the S&P 500 Index underperformed their non-paying counterparts in the month of October. The payers October monthly return equaled 2.34% versus the non-payers return of 2.84%. On a year to date basis, the payers lagged the non-payers as well, 6.01% versus 7.13%, respectively. A large part of the underformance can be attributed to the weak results from the financial sector. The financial sector weighting in the S&P 500 is nearly 19% of the index. During October the financial sector declined -1.99% versus an overall index return of 1.48%.

Posted by

David Templeton, CFA

at

6:20 PM

0

comments

![]()

![]()

Labels: Dividend Return

Posted by

David Templeton, CFA

at

6:46 AM

0

comments

![]()

![]()

Labels: Technicals