The yield curve is a graph of interest rates from short term to long term. In the U.S. the rates used are treasury security interest rates. The "normal" shape of the yield curve is where short term interest rates are lower than long term interest rates. Conversely, when short term rates are higher than long term rates the curve is said to be an "inverted" one.

Several factors impact the shape of the yield curve: inflation expectations, supply & demand and future expectations for economic activity to name a few. For example, if the yield curve is inverted, an investor might settle for a lower rate paid on a long term bond if the investor believes the economy will slow. A slower economy would indicate the Federal Reserve could lower short term rates below the level of long term rates in an effort to stimulate economic growth. This inversion tends to precede slower economic activity by up to a year. It should be noted that every inverted yield curve occurrence has not lead to a subsequent recession.

Several factors impact the shape of the yield curve: inflation expectations, supply & demand and future expectations for economic activity to name a few. For example, if the yield curve is inverted, an investor might settle for a lower rate paid on a long term bond if the investor believes the economy will slow. A slower economy would indicate the Federal Reserve could lower short term rates below the level of long term rates in an effort to stimulate economic growth. This inversion tends to precede slower economic activity by up to a year. It should be noted that every inverted yield curve occurrence has not lead to a subsequent recession.

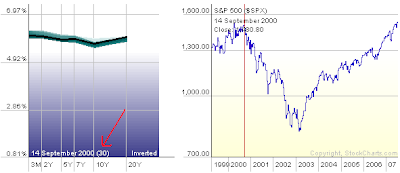

Yield Curve and S&P 500 September 2000

Yield Curve and S&P 500 March 2007

Over the last week or so long term interest rates have experienced a rapid and relatively large move to the upside as noted in the following chart below. This move higher in longer term rates has resulted in an un-inverted curve.

Over the last week or so long term interest rates have experienced a rapid and relatively large move to the upside as noted in the following chart below. This move higher in longer term rates has resulted in an un-inverted curve. What does this increase in interest mean for the economy? A good analysis is written by James Hamilton, professor of economics at the University of California, San Diego, titled More on those Rising Interest Rates.

What does this increase in interest mean for the economy? A good analysis is written by James Hamilton, professor of economics at the University of California, San Diego, titled More on those Rising Interest Rates.Several other discussions on the yield curve are available by clicking the links detailed below:

- Action in Long-Term Interest Rates, by Kash Mansori

- The Yield Curve: A Route to Better Investment Decisions, by Deborah Weir, CFA

No comments :

Post a Comment