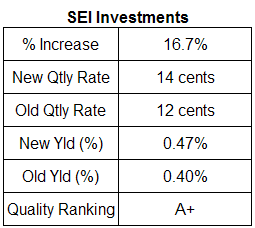

As noted in yesterday's post, many times it is not the level of the indicator, but the direction in which it is moving. In the case of bullish sentiment, it continues to move higher since 2003, albeit from a lower level.

Posted by

David Templeton, CFA

at

9:10 PM

0

comments

![]()

![]()

Labels: Technicals

Short interest is the total number of shares of a particular stock that investors have sold short in anticipation of a decline in the share price and have not yet repurchased the shares.Short interest is often considered an indicator of pessimism in the market and a sign that prices will decline. From a contrarian perspective, some view short interest as a positive sign, pointing out that short sales have to be covered, and that the need to repurchase the shares sold short can increased demand for a particular stock potentially forcing the stock price to move higher.

So-called contrarians typically see such bearishness as a reason to buy. The idea is that when investors are down on stocks, expectations are so low that the slightest inkling of good news can send prices higher. In contrast, when investors get too bullish, stocks get priced for perfection, and when perfection doesn't come, stocks decline.

But with hedge funds cutting a much bigger swath in the market, today's high level of short interest doesn't represent the bearishness that it did in the past. Many hedge funds engage in a strategy of offsetting the purchase of shares in one company by shorting another, betting that it will perform worse than the stock of the company that they own. Then there is the booming deals market, which drives merger arbitrage, where investors buy shares of companies set to be acquired and short the acquirers.

Posted by

David Templeton, CFA

at

10:13 PM

0

comments

![]()

![]()

Labels: Technicals

| Removed | Ticker | Yield |

|---|---|---|

| Kinder Morgan, Inc. | KMI | 3.30% |

| Duquesne Light Holdings Inc. | DQE | 5.00% |

| Added | Ticker | Yield |

| Wilmington Trust Corp. | WL | 3.20% |

| Trustmark Corp. | TRMK | 3.30% |

Posted by

David Templeton, CFA

at

2:01 PM

1

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:54 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

10:26 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

8:13 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

8:28 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

6:24 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

7:38 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

The justices delayed a decision on hearing the Kentucky dispute until they ruled in a fight over two New York counties that require trash to go to designated, publicly owned facilities. The court on April 30 upheld the rules on a 6-3 vote, rejecting arguments by haulers who said they were illegally barred from shipping to out-of-state sites with lower fees.

Both cases center on the so-called dormant commerce clause, a court-created rule that bars states from discriminating against out-of-state business without congressional authorization.

The case also raises questions about state tax treatment of college savings funds, said Leonard Weiser-Varon, a lawyer specializing in public finance at Mintz Levin in Boston.

Posted by

David Templeton, CFA

at

9:11 PM

0

comments

![]()

![]()

Labels: Bond Market

Just look at some of the strongest sectors of the stock market in the past two years: electric utilities, real-estate investment trusts, cigarette makers, telecommunications providers and energy-oriented master limited partnerships. All of them pay nice dividends.

"A lot of corporations are missing the seismic shift in retail demand for yield," says Henry McVey, chief investment strategist at Morgan Stanley. As tens of millions of baby boomers start retirement, the demand for yield-oriented investments will climb. McVey notes that Americans over 65 have equity portfolios with an average yield of 2.6%, versus 0.8% for those under 65.

The waning importance of dividends in the States reflects the rise in the past two decades of institutional investors, who tend to see stocks as vehicles for capital gains, not income. Historically, however, dividends have been crucial to investors. Since 1928, stocks have returned 10.4% annually, with 40% of that generated by dividends.

Posted by

David Templeton, CFA

at

10:20 AM

0

comments

![]()

![]()

Labels: Dividend Analysis

- There aren't 5,000 stocks anymore in the Dow Jones Wilshire 5000, a measure of the entire stock market. With fewer public companies, it has shrunk by 51 stocks, or 1%, this year and is down 89 stocks, or 2%, since 2005 to 4,910 now, Wilshire Associates says. There's no sign of the evaporation ending. "You're seeing a gradual shrinkage of the availability of public companies," says Richard Peterson of Thomson Financial.

- And it's not just small companies going away. This year, 12 members of the S&P 500, a benchmark index of large-company stocks, have been taken out by private buyouts and acquisitions, says Howard Silverblatt of S&P. An additional 17, including Bausch & Lomb, will disappear once their buyouts are completed, he says.

- Shares of remaining public companies become more valuable. Suddenly, stock investors have something the buyout firms want, putting a floor on their value, says Jack Ablin of Harris Private Bank. He estimates the dollar value of stocks available to the public has shrunk 6% the past year.

The company projected in February second-quarter earnings of 57 cents to 58 cents on roughly $24.5 billion in revenue. Excluding one-time costs, the company had forecast profit of between 63 cents and 64 cents per share for the quarter. Analysts expected earnings, on average, of 65 cents per share on $24.58 billion in revenue, according to a Thomson Financial survey. Higher levels of share buybacks during the quarter ending in April also contributed to the earnings lift, the company said (emphasis added).

Posted by

David Templeton, CFA

at

7:16 PM

1

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

8:28 AM

0

comments

![]()

![]()

Labels: Technicals

Posted by

David Templeton, CFA

at

3:02 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

9:59 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

The IRS ruling lets employers choose whether to amend their 401(k) plans to make IRA transfers more widely available. While some companies, including IBM (IBM), Eastman Kodak (EK), and MetLife (MET), have done so, many have yet to consider the matter.

The best way to avoid problems? When you retire or leave a job, transfer your 401(k) to an IRA. That gets your nest egg out from under an employer's rules. You may also be able to take a so-called in-service distribution. A growing number of businesses let employees transfer money out of the plan while they're still on the payroll, says Ed Slott, (editor of Ed Slott's IRA Advisor). With an IRA, your heirs will be subject to the more favorable tax treatment.

Posted by

David Templeton, CFA

at

8:59 PM

0

comments

![]()

![]()

Labels: Financial Planning

The extent to which the values of different types of investments move in tandem with one another in response to changing economic and market conditions.

Correlation is measured on a scale of -1 to +1. Investments with a correlation of +0.5 or more tend to rise and fall in value at the same time. Investments with a negative correlation of -0.5 to -1 are more likely to gain or lose value in opposing cycles.

...increased correlations are only part of the story. Even though markets are more directionally correlated than ever, they still have diverging total returns, reinforcing their diversification benefits.

While the S&P 500 index, the MSCI EAFE index, the MSCI Emerging Market index, the S&P MidCap 400, and the S&P SmallCap 600 index have all posted positive trailing five-year total returns, the magnitude of the gains has varied widely.

While the “500” has returned 9.5% annually over the past 5 years (through May 7), the MSCI EAFE index and the MSCI EM index have returned 17.2% and 25.9%, respectively, highlighting their powerful portfolio diversification benefits. Similarly, the S&P MidCap 400 index and the S&P SmallCap 600 index have posted returns of 12.5% and 12.6%, respectively, thereby adding value to a diversified portfolio. Hence, despite increasing directional correlation, the inclusion of a wide array of equity asset classes has significantly benefited portfolio performance.

But the main driver for employing structured products remains the theme of capital protection. “From the majority of client surveys that we conduct periodically, it emerged that around 40 per cent of our clients want to have guaranteed capital at maturity,” says Ms Viviani. “Moreover, we wrap structured products in a bond, meeting the favour of retail investors, who represent the large majority of Banca Intesa clients. They have traditionally invested in government or bank bonds, as they typically have a low risk profile.”

Posted by

David Templeton, CFA

at

11:15 AM

1

comments

![]()

![]()

Labels: Investments

Posted by

David Templeton, CFA

at

8:28 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

7:15 AM

0

comments

![]()

![]()

Labels: Technicals

"During the late 1990s, many individual investors were consumed with the capital appreciation of technology stocks that soared to record prices. After the bubble burst and a bear market took hold, many baby boomers facing retirement got spooked when their savings plummeted in value. They sought out investments that could provide extra income and weather stormy markets, leading them to rediscover the power of dividends..."

"Recent data indicate it was a smart shift. According to a Morgan Stanley report, stocks that paid dividends returned an average annual 10.2% from 1970 through 2005, almost six percentage points ahead of nonpayers. And dividend-paying stocks provide some protection in a down market, says John Gould, co-manager of Cullen High Dividend Equity Fund, an important attribute given the possibility that the market soon might slip after nearly five years of gains."

Posted by

David Templeton, CFA

at

7:53 AM

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

11:19 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

1:03 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

It is wrong to hail an increase in per-share earnings as if it is an “earnings surprise” – as if it reflects an improvement in corporate operating conditions, when it is in fact an expenditure of existing earnings on shares instead of on business investments. When such repurchases are done at rich valuations, they are a signal that the company lacks other productive business opportunities and is instead propping up per-share earnings by disposing of what it does earn.

Why haven't investors figured this out? The story constantly repeated on CNBC is that companies low-balled their earnings guidance in order to surprise investors with better than expected earnings (with the implication that the market will rise forever because companies can continue to do this indefinitely). A good part of the true story is that analysts made their forecasts of per-share earnings based on old, higher share counts, so the juiced per-share figures resulting from repurchases are now showing up as “earnings surprises.”

Posted by

David Templeton, CFA

at

11:45 AM

0

comments

![]()

![]()

Labels: Investments

Provided such flow control ordinances treat in-state private businesses exactly the same as out-of-state ones, they do not violate the so-called dormant Commerce Clause, the high court said. The constitutional clause stipulates that only Congress can erect barriers to trade between the states.

The decision has broad implications for the municipal bond market because it suggests that the existing system of muni bond financing, under which some 40 states exclude from taxation the interest earned on in-state bonds while taxing the interest earned on debt issued out-of-state, will probably be deemed lawful by the court in another dispute, market participants said.

"This decision says that when a state favors itself, it's either outside the commerce clause or under a more lenient version of the commerce clause," said Len Weiser-Varon, a partner at Mintz Levin Cohn Ferris Glovsky and Popeo PC. Yesterday's decision, in United Haulers Assoc. Inc. v. Oneida-Herkimer Solid Waste Management Authority, applies to a Kentucky bond dispute that is currently before the court in which a Kentucky couple, George and Catherine Davis, successfully challenged the constitutionality of the state's exemption for interest on bonds issued in state. Several attorneys who have been watching the case have speculated the Supreme Court was waiting to rule in the flow-control case before deciding if it will review the Davis matter."

Posted by

David Templeton, CFA

at

9:45 PM

0

comments

![]()

![]()

Labels: Bond Market

Posted by

David Templeton, CFA

at

6:55 AM

0

comments

![]()

![]()

Labels: Technicals

This type of announcement is one reason dividend growth investing is attractive. One doesn't need to be attracted to the stock for the income yield; but, the actions around the dividend will provide insight into the board's/management's views on future financial results. If the company begins lowering the dividend growth rate below estimated earnings for a particular year, there is a likelihood the company is seeing a slowing of earnings. Of course, the company could be doing other things with the cash, e.g., an acquisition."The Company increased its dividend payout target to 50% of prior year's earnings, beginning with its May dividend declaration."

"PepsiCo also said it will buy back up to $8 billion in shares through mid-2010, after the current buyback program is complete. The current $8.5 billion authorization began in 2006 and has about $6 billion remaining.

PepsiCo expects about $4.3 billion in share buybacks in 2007, up from a previous forecast of $3.3 billion, and annual share buybacks of $4 billion to $5 billion over the next several years."

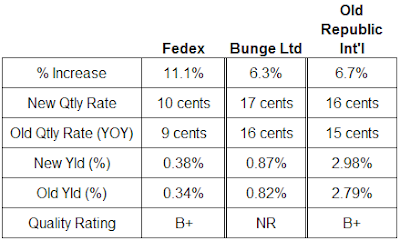

(click on table/chart for larger image)

Posted by

David Templeton, CFA

at

8:03 PM

0

comments

![]()

![]()

Labels: Dividend Analysis

Posted by

David Templeton, CFA

at

8:58 PM

0

comments

![]()

![]()

Labels: Dividend Analysis