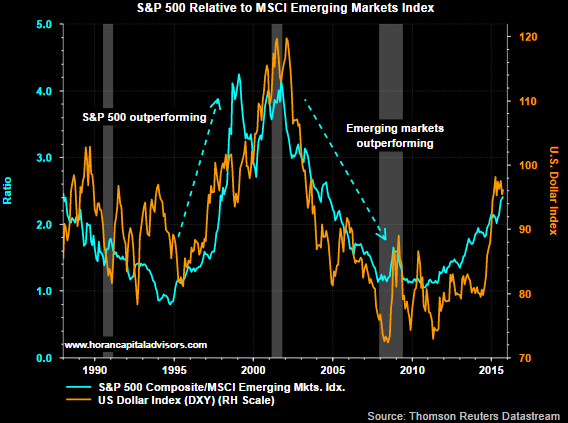

Since mid 2011 emerging market equities began to underperform the U.S. equity market (S&P 500 Index). Earlier this year we noted in a post, Emerging Markets Not Out Of The Woods Yet, the headwind a stronger U.S. Dollar can have on emerging market equity performance. The updated chart below continues to show the accelerated strengthening of the Dollar (orange line) and the underperformance of the MSCI Emerging Markets Index relative to the S&P 500 Index.

|

| From The Blog of HORAN Capital Advisors |

The U.S. Dollar tends to move in an average cycle of about seven to eight years and this cycle is about four years old. A number of factors can contribute to a stronger Dollar. One factor is a higher interest rate trend in the U.S. and the Fed's desire to raise rates continues to place an upward bias on the Dollar.

Investors seem to be taking note of the headwind facing the emerging markets as ETF fund outflows have accelerated. Today, in a Bloomberg report, it was noted,

- Outflows from U.S. exchange-traded funds that invest in emerging markets more than doubled last week, with redemptions exceeding $12 billion in the third quarter.

- Withdrawals from emerging-market ETFs that invest across developing nations as well as those that target specific countries totaled $566.1 million compared with outflows of $262.1 million in the previous week.

- The losses marked the 13th time in 14 weeks that investors withdrew money from emerging market ETFs and left the funds down $12.4 billion for the quarter, the most since the first quarter of 2014, when outflows reached $12.7 billion. For September, emerging market ETFs suffered $1.9 billion of withdrawals.

As difficult as it can be to predict currency moves, getting the directional call correct will likely be a factor that influences emerging market returns over the next several years. A stronger Dollar will serve as a headwind and a weaker one could be a positive for emerging market equities.

No comments :

Post a Comment