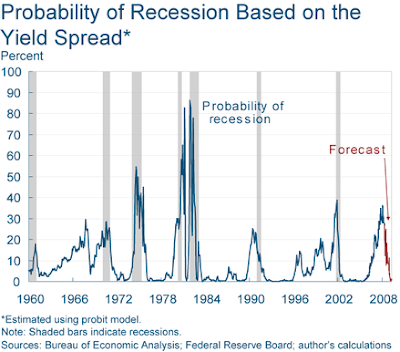

According to the Federal Reserve Bank of Cleveland, one year ago the yield curve was predicting there was a 35% chance the U.S. economy would be in a recession by May 2008. At that time, many thought this high probability was not realistic. Fast forwarding to today, the higher probability predicted last year seems to have been somewhat correct in that the economy has certainly slowed.

Instead of looking in the rear view mirror, today's yield curve might be predicting stronger economic growth one year in the future. According to the Cleveland Fed study, "...the expected chance of the economy being in a recession next May stands at 0.9 percent, just below April’s 1 percent, and March’s 2.7 percent."

Instead of looking in the rear view mirror, today's yield curve might be predicting stronger economic growth one year in the future. According to the Cleveland Fed study, "...the expected chance of the economy being in a recession next May stands at 0.9 percent, just below April’s 1 percent, and March’s 2.7 percent."

Although the article notes the yield curve does not do a great job in predicting the actual rate of GDP growth, based on the yield spread,

Projecting forward using past values of the spread and GDP growth suggests that real GDP will grow at about a 3.0 percent rate over the next year. This is on the high side of other forecast.

Lastly, as the yield curve steepens (wider yield spread) it does appear future economic activity is stronger one year later. The below chart graphs the yield spread versus GDP lagged by one year.

Lastly, as the yield curve steepens (wider yield spread) it does appear future economic activity is stronger one year later. The below chart graphs the yield spread versus GDP lagged by one year. Two related posts on the yield curve are noted below.

Two related posts on the yield curve are noted below.Source:

The Yield Curve

Federal Reserve Bank of Cleveland

By: Joseph G. Haubrich

May 13, 2008

http://www.clevelandfed.org/research/trends/2008/0608/01monpol.cfm

No comments :

Post a Comment