Before May and now the first day of June, it seems the S&P 500 Index desires to do anything but move higher. The S&P 500 Index had advanced over 9% through the first four months of the year. It is not reasonable to think the market can move higher by 9% every four months. So in May, the S&P declined 1.13% and June is starting off on a weak note by declining 2.28%. After the markets decline today, the S&P 500 Index is still up 5.38% on a year to date basis.

The next support level for the S&P is 1,305; however, it is difficult to guess market bottoms. From a fundamental perspective though, valuations for large cap U.S. equities continue to look more and more attractive. The forward four quarter P/E ratio for the S&P 500 Index is 12.8 times based on projected earnings of $103.57 for the S&P 500.

The next support level for the S&P is 1,305; however, it is difficult to guess market bottoms. From a fundamental perspective though, valuations for large cap U.S. equities continue to look more and more attractive. The forward four quarter P/E ratio for the S&P 500 Index is 12.8 times based on projected earnings of $103.57 for the S&P 500.

|

| From The Blog of HORAN Capital Advisors |

|

| From The Blog of HORAN Capital Advisors |

The sell off today was triggered by the weaker than expected ADP payroll report. Unfortunately, we believe this type of weaker, or less than robust, economic data will be the norm over the course of the next 6-12 months. The unemployment rate will likely remain stubbornly high as we noted on page 3 of our first quarter investor letter.

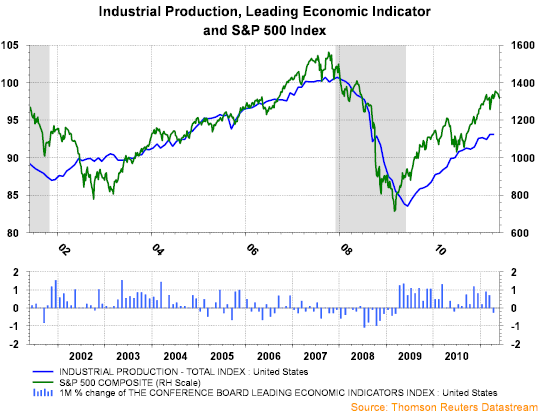

The small down tick in the U.S. Leading Economic Index is not unusual when the economy is entering the mid-cycle of a recovery.

The small down tick in the U.S. Leading Economic Index is not unusual when the economy is entering the mid-cycle of a recovery.

|

| From The Blog of HORAN Capital Advisors |

Additionally, companies have reduced inventory levels relative to sales to the point that a slight improvement in demand will likely result in the need to increase manufacturing to replenish stocks.

|

| From The Blog of HORAN Capital Advisors |

And finally, as Liz Ann Sonders notes in a recent strategy article, Chief Investment Strategist at Charles Schwab & Co. (SCHW),

"The...massive flow disruptions in Japan are already beginning to turn. Commodity prices have come off the boil. Finally, both monetary and fiscal policy remains stimulative; even considering the finale of QE2 in a few weeks. The Fed has no intention of draining its balance sheet any time soon, nor raising rates.

Corporate America has rarely been healthier, and the cash firepower available to companies is massive. Debt-to-equity for US companies is at its lowest in over 20 years and they hold nearly $2 trillion in cash on their balance sheets.

With leverage so low, if it simply returned to the average of the past decade, companies would have an extra $2.7 trillion to spend, according to the Financial Times. Deal-making is back.

In sum, growth has certainly slowed, but many of the contributing factors are temporary in nature. Assuming US GDP growth can rebound back above 2%, historically this isn't a bad backdrop for stocks. Looking at all years when US GDP growth was between 2% and 3%, the average return for the S&P 500 was nearly 14%, with only two down years out of 11 total. Not bad (emphasis added)."

Disclosure: Long SCHW

No comments :

Post a Comment