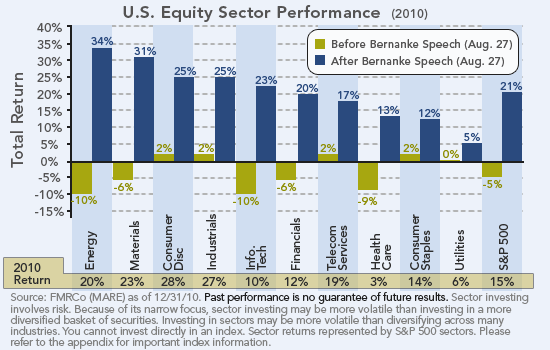

On August 27th of last year Ben Bernanke's speech at the Jackson Hole, WY meeting signal beginning of the Fed's second round of quantitative easing. Since the speech the stock market has responded favorably for long equity investors.

|

| From The Blog of HORAN Capital Advisors |

Source: Viewpoint-Fidelity

Not only have equity prices reacted favorably to the Fed Put, many commodity assets have responded as well and noted in our post, More Evidence Of Inflation In The System.

I do not recall the source of the below chart; however, during the Fed's first round of quantitative easing, the market experienced strong upward returns. The market's positive return during QE1 could be viewed as a coincidence; however, the quantitative easing dollars need to flow somewhere, and risky asset prices seem to be the beneficiary. This has been a stated desire by the Fed as well.

I do not recall the source of the below chart; however, during the Fed's first round of quantitative easing, the market experienced strong upward returns. The market's positive return during QE1 could be viewed as a coincidence; however, the quantitative easing dollars need to flow somewhere, and risky asset prices seem to be the beneficiary. This has been a stated desire by the Fed as well.

|

| From The Blog of HORAN Capital Advisors |

One question that comes to mind is what will be the market's reaction once QE2 comes to an end in June. One date that might be of importance is the Fed's Humphrey-Hawkins testimony before Congress in February. Given the change in the control of the House to the Republican side and their prior opposition to quantitative easing, might the Fed step up the QE program and have it end around the time of the Humphrey Hawkins testimony? Ron Paul, who has not displayed much favor for the Federal Reserve, has been named Chairman of the Subcommittee on Domestic Monetary Policy and Technology, the committee charged with overseeing the Federal Reserve.

No comments :

Post a Comment