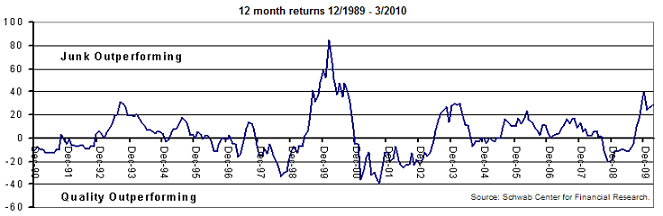

There is no doubting the strong market return that has occurred over the past 12-months. One characteristic of this advance is the fact lower quality stocks as measured by S&P's Earnings & Dividend Quality Ranking have mostly outperformed the higher quality ones.

|

If one looks at stocks like Abbott Laboratories (ABT) that has an S&P Quality Ranking of A and MGM Mirage (MGM) that has an S&P Quality Ranking of B-, MGM has outperformed ABT and the S&P 500 Index by a pretty wide margin.

In a recent study by Schwab's Center for Financial Research, they show that higher quality tends stocks tend to outperform lower quality stocks in the periods following large outperformance by lower quality stocks.

In a recent study by Schwab's Center for Financial Research, they show that higher quality tends stocks tend to outperform lower quality stocks in the periods following large outperformance by lower quality stocks.

"When quality underperforms junk by 20% or more, the subsequent 12-month relative return tends to favor quality, on average, by 4.5%. On average, quality has outperformed junk by 11.5% in the year following large junk rallies (over 40%)."

Generally, the highest rating a non dividend paying stock will receive from S&P is A-; therefore, the A+ and A rated stocks tend to consist mostly of dividend paying companies.

If history does repeat itself, returns for higher quality stocks over the course of the next 12-months are likely to outpace the lower quality ones. Currently, lower quality stocks are outperforming higher quality ones by over 28 percentage points. Additionally, given the global economic issues that bubbled to the surface today, i.e., sovereign debt issues with Greece and possibly Portugal, higher quality stocks are likely to be a safer bet than lower quality ones.

If history does repeat itself, returns for higher quality stocks over the course of the next 12-months are likely to outpace the lower quality ones. Currently, lower quality stocks are outperforming higher quality ones by over 28 percentage points. Additionally, given the global economic issues that bubbled to the surface today, i.e., sovereign debt issues with Greece and possibly Portugal, higher quality stocks are likely to be a safer bet than lower quality ones.

Source:

Where Is Quality Hiding

Charles Schwab & Co.

By: John Wightkin, CFA

April 27, 2010

http://www.schwab.com/public/schwab/research_strategies/market_insight/investing_strategies/stocks/where_is_quality_hiding.html?cmsid=P-3549031&lvl1=research_strategies&lvl2=market_insight

Disclosure: long ABT

No comments :

Post a Comment