One area of the market investors can find dividend paying stock opportunities is in the midcap value universe. Standard & Poor's notes:

"As a whole, the Standard & Poor’s MidCap 400 index boasts a dividend yield of 1.5%. But when the index is divided into growth and value stocks, the value stocks’ average yield is 2.7%, higher than the yield on growth stocks (0.8%)."

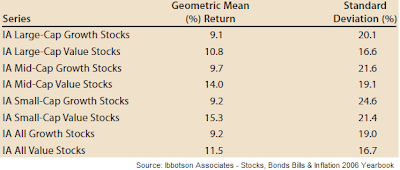

Often times this area is overlooked due to concerns about the increased volatility of this space versus large cap stocks. However, if one looks at the return relative to the volatility, midcap value stocks come out on top from a risk return standpoint. As the two tables below show, midcap value stocks actually exhibit lower volatility than a number of the other asset classes. At the same time, the historical returns are the highest except for small cap value stocks. The second table then details the return divided by the risk, resulting in the midcap value universe generating the highest return per unit of risk.

(click on tables for larger image)

Standard & Poor's publishes a list of Global Challengers that consist of domestic and international midcap stocks. The stocks on the list generally have a market capitalization from $1 billion to $5 billion. The global challengers list (PDF) details 300 companies from 33 countries across nine economic sectors. The list is generated based on the following attributes.

Standard & Poor's publishes a list of Global Challengers that consist of domestic and international midcap stocks. The stocks on the list generally have a market capitalization from $1 billion to $5 billion. The global challengers list (PDF) details 300 companies from 33 countries across nine economic sectors. The list is generated based on the following attributes.- share price appreciation

- sales growth

- earnings growth

- employee growth

The one factor not used in constructing the list is a dividend attribute. However, investors doing their own research can review the dividend characteristics on their own. Sam Stoval of S&P noted in June.

"Mid-cap stocks have less exposure to subprime mortgages, and many of them are initiating or adding to dividends—even as some large-cap stocks cut their dividend payments."

Source:

Galileo's View (PDF)

Touchstone Investments

Prepared by: Clover Capital Management, Inc.

January, 2007

https://www.touchstoneinvestments.com/shared/formslit/pdf/TSF1184.pdf

The Cream of the Mid-Cap Crop

BusinessWeek

By: Beth Piskora

June 5, 2008

http://www.businessweek.com/investor/content/jun2008/pi2008064_825583.htm

Stocks: Nine Up-and-Coming Mid-Caps

BusinessWeek

By: Beth Piskora

August 15, 2008

http://www.businessweek.com/investor/content/aug2008/pi20080814_865704.htm

Mid-Cap Value Funds ($)

The Outlook

By: Beth Piskora

September 17, 2008

http://www.outlook.standardandpoors.com/NASApp/NetAdvantage/servlet/login?url=/NASApp/NetAdvantage/index.do

No comments :

Post a Comment